Advertisement

Supported by

Investors have set aside the almost relentless pace of bad news to give any sign that the worst of the coronavirus pandemic could have ended.

By Matt Phillips

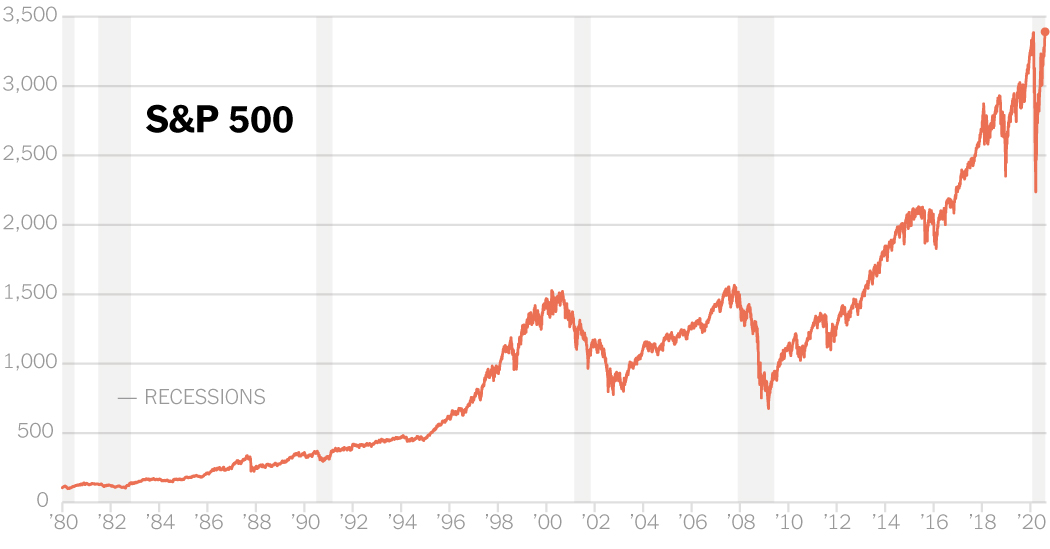

Widespread economic devastation, severe unemployment, and a grim recovery have not ended stock market exuberance, and on Tuesday, that eternal optimism propelled the market to a new record, pushing it beyond a milestone just six months ago, as the coronavirus had just started its heartbreaking U.S. adventure.

“This market is crazy,” said Howard Silverblatt, senior index analyst for S-indices

For those outdoors on Wall Street, the rise in the market might seem inexplicable given the human and economic cost of the virus and a stagnation in Washington that has paralyzed efforts to provide more relief than many businesses and staff desperately need.Investors have set aside the almost relentless pace of bad news to focus on any sign that the worst may also have happened.They were also encouraged by the Fed’s unwavering attitude to markets and the unwavering adoption of low interest rates.

Investors are considering that the virus, which had experienced a recent outbreak threatening to push back much of the country for a moment, has shown signs of a decline, with a number of new instances falling to 16% in the more than 14 years.According to knowledge compiled through the New York Times, business profit expectations for 2020, established through Wall Street analysts, seem to have stopped falling.In addition, slow but significant progress towards a vaccine, which many brands and public fitness experts can simply be in a position until next year, have made many investors optimistic.

And the economy is improving, even if the recovery is lukewarm.About 1.8 million new jobs were created in July and state programs for weekly unemployment fell below one million for the first time since March.

Together, these knowledge problems were enough to create an attitude that, not entirely pink, is at least paler.At the same time, innovations are not significant enough to cause the Fed to withdraw its aid to the economy.The Fed has introduced new systems to buy Bonds from the Treasury and other monetary assets to calm investors, and is investing in those systems by necessarily creating a new currency.

“It turns out to me that markets have made the decision that this economic environment is the most productive of the two worlds: a sufficient economic recovery for corporate profits and avoiding a truly extensive recession, but not to the point where the Fed deserves to raise interest rates and tighten financial policy,” said Scott Clemons, a leading personal banking investment strata at Brown Brothers HarrimanArray , an investment bank.

Several times in days, the S

Advertisement