InvestorPlace – Stock Market News, Inventory and Trading

I’ve talked to many other people about how to make a bitcoin investment over the years and almost everyone just needs undeniable advice: do I invest in bitcoin?

They gave it to me. It’s hard to get an undeniable recommendation in those days. On the one hand, Bitcoin fans have a tendency to advertise cryptocurrencies in a vacuum; on the other hand, investors historically from the old world will reject the idea without delay. Unfortunately, there’s not much between them.those two extremes.

And that leaves a lot in the dark.

Similarly, InvestorPlace advisor Matt McCall, one of the first to expect the bitcoin surge, shared key investments for a bitcoin surge. If you come out of your more positive search for bitcoin and cryptocurrencies, then McCall’s forecasts are a reading to invest in. bitcoin.

Finally, once you start to perceive what drives the value and demand for bitcoin, I promise you this: you will know temporarily if you invest in bitcoin.

$25,000 in 2013 Bitcoin is $2.2 million today

It is easy to get lost in the technical jargon of bitcoin and other cryptocurrencies: hash algorithms, evidence of work, Merkle Trees.The list is getting longer and longer. These are all essential concepts for someone looking to create a secure payment system.

If you want to invest in bitcoin, you want to know 3 key factors:

Bitcoin belongs to an elegance of assets called cryptocurrencies: virtual currencies that use cryptography for secure payments.

Why is cryptography so vital for virtual currencies?Because each and every coin wants security measures.Here’s how the top 3 security measures compare:

Physical Currency: The U.S. Bureau of EngravingIt uses complex safety features to prevent counterfeiting, including watermarks, shiny threads, embossed printing, color-changing ink, and more.

Cryptocurrency: Bitcoin and other cryptocurrencies use encryption techniques to buy monetary knowledge in the form of “hash”, a method that the clinical network considers highly secure.

Like the physical currency, virtual currencies also want a way to avoid counterfeiting.

In the virtual world, knowledge can be quickly stolen, duplicated, hacked or removed. Most readers will not be surprised to learn that in 2018, Americans lost 10.83 cents for every $100 of cardholder expenses, more than 1000% of the fraud discovered on paper currency That’s where cryptocurrencies come in.

Cryptography began at least 6000 years ago in ancient Egypt, but it wasn’t until the PC era that science was fast enough for everyday use.Today, the maximum of cryptocurrencies, adding bitcoins, using a highly secure hash serves as wallets and Payments.These are services that convert a knowledge chain or passwords into a complex hash that only a user with the decryption key can unlock.

The encryption point is very sophisticated. Someone who has had the full bitcoin mining force lately would still take 7.4 x 10-51 years (or 7.4 with 51 zeros later) to break a password with brute force That’s more years than the number of atoms on Earth!

In other words: don’t lose your Bitcoin wallet password, you will have to wait a long time to get it back.

While cryptocurrency is how secure bitcoin is, the “blockchain” is the way knowledge is recorded.Simply put, it’s the record of the coin industry.

Bitcoin author Satoshi Nakamoto illustrates blockchain concept

Think of it that way. In the physical world, other people can’t spend twice as much money.Once they give you a dollar-on-paper bill, they can’t give that same dollar to someone else.It’s a physical impossibility.

How other currencies challenge double spending

In the virtual world, however, things get complicated, how do I know if a valid payment is being made?The client may have simply made a virtual copy of a token, no matter what the merchant knows.Currently, merchants use external intermediaries such as Visa or PayPal (NASDAQ: PYPL) to approve or deny payments.But the formula is far from perfect. According to Fundera, a small business loan company, merchants pay between 1.7% and 3.5% in credit card processing fees, exceeding the maximum that small businesses earn on gross profit margins.

The steps in Visa / Mastercard mean big profits for payment processors at the expense of the corporations they serve.

This means that transaction fees for bitcoins can be as low as 0-1%, according to researchers at the KTH Royal Institute of Technology.Small businesses have begun to take note of this.Today, 2,300 small U.S. corporations now settle for bitcoin, as well as thirteen giant national corporations.

There is one fundamental thing that makes bitcoin (although many cryptocurrencies have copied it since then).

Your blockchain is one hundred percent public.

This means that anyone who has a computer and an Internet connection can log in and read the entire blockchain.It’s true. You do not want to be a trader or connoisseur to view any and all of the transactions that have already been made.

“Imagine all the other people who have a supercomputer in their pocket, who are connected to a network but don’t have a bank account,” said Don Tapscott, an assistant professor at INSEAD, in an interview with McKinsey. 2 billion more people can be brought into the global monetary system. What can that do?

Even in the United States, 25% of families do not have banking services or are underbanked.These are other people who don’t have a bank account or who want non-banks, such as payday lenders, to make it to the end of the month.

And as everyone will tell you, life without a bank account is easy.

This is where bitcoin and other cryptocurrencies come in. According to Tapscott, cryptocurrencies can allow others to spend, borrow, and save cash without the maximum or minimum account rates that currently exist.Imagine a world you can safely send cash to in You may simply replace everything from industry to insurance, from banks to charitable donations.

New technologies already have the payments industry.

In 1973, Bank of America (NYSE: LAC) created the first electronic authorization formula for its credit card business, laying the groundwork for the VisaNet payment network.Today, Visa (which Bank of America founded in 1976) and its peers oversee an cashless $3.9 trillion Bills system.

Visa’s initial network of 76 credit card centers has a billion-dollar business

Can cryptocurrency bring a new wave of exchange? Investors seem to do it.

In 2017, the CME Group (NASDAQ: CME) created bitcoin futures after seeing the widespread adoption of the currency among professional and institutional investors.The Group continued in 2020 with Bitcoin options.

CME Bitcoin futures allow investors to hedge cryptocurrency risk on a major global stock exchange

In April 2020, Andreessen Horowitz, a leading venture capital group, presented a $515 million cryptocurrency fund.”Consumers, especially on-premises virtual users and those whose currency is not stable, need a modern price reserve that is rare, safe, durable and portable.and resistant to censorship, ” wrote the company.” Bitcoin is a virtual alterlocal that is being accepted and followed around the world.”

The popularity of Bitcoin is vital for investors. While smaller cryptocurrencies may outperform with a smaller initial size, none can compete with bitcoin for commercial acceptance, software ecosystem, or ad liquidity, and smaller altcoins also have a 51% threat. superior attack, which occurs when a single entity takes most of the computing power of a room. The miner can then rewrite the blockchain of the work in his favor.

I’m getting this question. People ask: if I invest in bitcoins, is it absolutely legal?

And what’s the short answer? Yes, Bitcoin is legal in the United States, but it’s complicated.

The Internal Revenue Service (IRS) has issued on bitcoin taxes

Most evolved countries have laws that recognize the legitimacy of cryptocurrencies and identify express fiscal frameworks.These countries come with the EU, Canada, Australia, Japan, South Korea and many others.The Library of Congress has published its foreign consultant here.

But what about the app? That’s where things get complicated.

In 2017, a California court ordered Coinbase, a U.S.-based cryptocurrency exchange.U.S., To advance the names of 14,355 users to the Internal Revenue Service.Since then, relations between courts and cryptocurrency exchanges have become strained.China has banned local cryptocurrency exchanges in 2017 while urging technological innovation.

These prohibitions reflect the weakness of some central banks, such as Zimbabwe’s central bank, which banned the use of the US dollar in 2019, and the country seeks to protect its inflationary currency from black market speculation.

Weaker central banks fear allowing their citizens to use election currencies

Bitcoin’s privacy criteria make it a double-edged sword.On the one hand, users can have general privacy if they wish.Anyone can create an un named account in the blockchain and start trading.On the other hand, Bitcoin’s privacy has made it a means of selection in the Darknet Online (DNM) markets.

Bitcoin is among the users of the Darknet provider network

Today’s electronic systems suffer from their own fraud problems

This is where top investors care about cryptocurrencies and bitcoin.

And I’ll tell you why they’re right to worry.

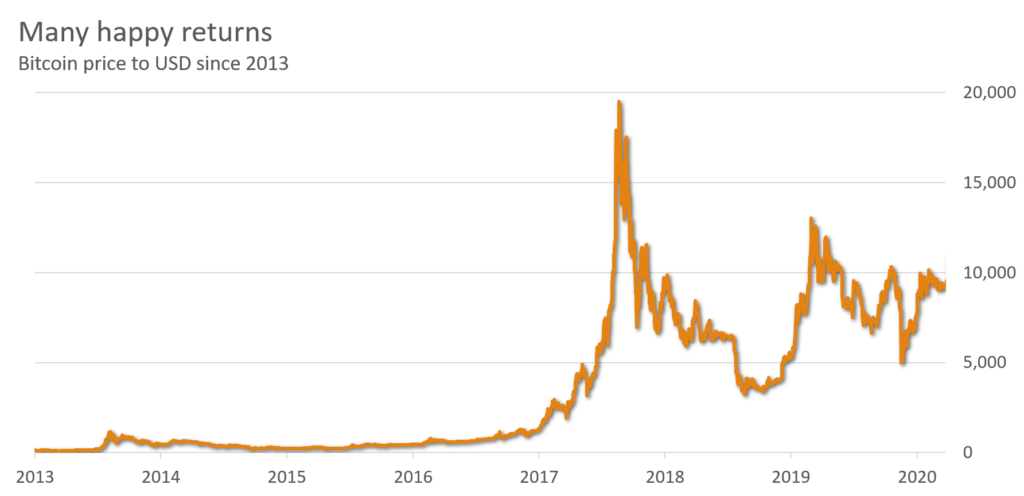

Investors who bought bitcoins in December 2017 suffered a massive impact: over the next 12 months, they slipped from $17,802 to $3,236, erasing $242 billion in investor wealth.

Bitcoin, however, also rewarded patient investors.As mentioned above, an investor who bought a value of $25,000 of bitcoin in 2013 would have noticed that its wealth increased to $2.8 million even after the fall of 2018.I want for retirement.

Bitcoin has recovered from serious fraud and theft over the years to become the sixth largest currency in the world.

So a considerate user invests in Bitcoin? Here are the 3 key points to consider.

On the other hand, leaving too little space in a position can spell a missed opportunity. Peter Lynch, Fidelity’s fund manager, called the procedure “desorption.” This is when scared investors fill their portfolios with too many mediocre assets instead of investing with conviction.

Finding the balance

There are several tactics to position the size well.Warren Buffett once advised investors to make a punch card in 20 locations, representing all the investments made during his lifetime.

Investing with conviction requires patience and willingness to invest at the right time.

But in the end, diversification in the individual.

In other words, before you put 5% of your wallet in bitcoin, ask yourself: can I lose 5% of my net worth if Bitcoin collapses?

Amazing yields aren’t enough to inspire others to invest, so you rarely see other people putting their savings on a circular on casino roulette.

Do not treat bitcoins from other investments.

Digital currencies have also disappeared before. Flooz, Digicash, Beenz and many other Internet currencies fell in the last decade of 1990 after fraud and liquidity shortages ended confidence.

Even Bitcoin has noticed several cases of high-profile fraud. Between 2011 and 2014, hackers broke into the Mt cryptocurrency exchange.Gox and stole $3 billion in securities. (A 2014 investigation revealed that the exchange stored its passwords on uns encrypted servers.)

For more than two decades, experts have warned users about virtual currencies.

This is what I call making an investment with conviction.In other words, don’t invest in bitcoins because your neighbors ask you and don’t buy it just because you expect bitcoin to increase.

Instead, invest in bitcoin because it will increase.

Investors in stocks lose out because they don’t act with conviction about smart ideas

So bitcoin will happen? This is the genuine million-dollar factor my InvestorPlace colleagues have been debating for some time.We’ll take care of this factor in the next section.

People can spend hours arguing about Bitcoin value forecasts and all you get is an angry or frustrated friend, so by doing that, I inspire other people to use Bitcoin with a transparent frame in mind.

Investing in Bitcoin in the short term: in the short term (i.e. from a few minutes to a few days), the call for buyers and distributors determines the costs.Technical research works well in such cases, as evidenced by foreign exchange educational studies.In fact, if everyone expects costs to fall, expectations become a self-fulfilling prophecy as buyers reduce their offerings.

Investing in Bitcoin in the medium term: In the medium term (i.e. days or months), costs tend to stick to the “value reserve” model, as do gold.Investors in search of safe havens temporarily rush to and from asset classes, creating wild fluctuations that are not noticed in other asset classes.

Invest in Bitcoin in the long run: in the long run (years or decades), costs will stick to valuation as currency.”The valuation of those general payment tokens [i.e. bitcoin] would be similar to the way we value currencies.”says Will Cong, associate professor of finance at Cornell University.”For example, the source of cash and speed would be vital determinants.Political considerations would also be vital.”

But if you don’t have that, you also show a strategy: buy and hold.If you have an inventory that’s up 1,000%, why jump and go when you can enjoy all the benefits?

This brings me to the vital top query for those who need to invest in bitcoin: Investors who buy and hold another 10,000%? Or will they lose 100 percent of what they put in?

Here are the 3 key points that will mark bitcoin’s long term.

1. Widespread adoption through users

To illustrate the concept: many foreign travelers for the first time are surprised to see that their local currency does not paint everywhere; give a $5 bill to a US cashier.But it’s not the first time And nothing will appear out of place; give the same cashier two hundred rupees.keep in mind, however, and watch the confusion unfold.

Accepted throughout India, both in the U.S.

Bitcoin works the same way. If you start to see more and more local corporations accepting bitcoins, there’s a better chance you’ll open a Bitcoin wallet, and the more people use the currency, the more sales options they’ll start accepting payments.a virtuous circle that will inspire the widespread adoption of cryptocurrencies.

This is why I pay so much for the number of wallets used. This is a leading indicator of the popularity of bitcoin at some point.

2. Trust in the system

“Bitcoin’s infrastructure is related to low bank confidence and monetary formula among the population of one region,” writes Ed Saiedi and others in Small Business Economics, “and the emergence of inflationary crises at the country level.”

In other words, other people are adopting bitcoin faster in countries where confidence disruptions and inflation are a concern.

Argentine peso drop has boosted the use of bitcoin

3. Relevant ecosystem

Every new generation wants an ecosystem to thrive. Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT) would not have been imaginable without extensive cellular Internet access (imagine looking to use Uber on the Internet via a dial-up line).owes much of its good luck to the progression of secure payment systems on the Internet.Even Tesla (NASDAQ: TSLA), which built its own charging network, would not have been imaginable without inventions like larger lithium-ion batteries.

Bitcoin will also want a multitude of systems to keep moving forward.

For example, generation limitations limit transaction speeds to approximately seven according to the time (compared to visa capacity of 65,000 consistent with the time).So, if other people start using bitcoin for daily transactions, verification times can be so slow that the currency cannot be used.To trump these limitations, corporations would like to create “off-chain” transactions that would gather many small bills and organize them into a singles blockchain application.

Traditional analysts at JPMorgan and other corporations have tried to compare bitcoins with classic investments such as gold or stocks.They characterize terms as “intrinsic value” as if mining prices dictate bitcoins.(This is not the case, thanks to an automatic setting function)

Instead, the value of bitcoin has more in common with Picasso’s eggs, Fabergé eggs and collectibles.In other words, they belong to an elegance of assets that the CFP’s board of directors describes as “collectible objects”.

What does that distinction do? There are 3 key factors:

Bitcoin’s costs are much more in non-unusual with collectibles than with commodities or stocks

To use an analogy with sport: When professional baseball players gain momentum, they not only watch incoming baseball, but also pay attention to the pitcher: how the pitcher goes, screws up and throws the ball.All those moves give clues about baseball’s fate.

Bitcoin (and many other investments) adhere to this principle.If you need to know where bitcoin costs will go, not only take a look at the costs, but be sure to pay attention to the global that surrounds it as well.

Now that you’re in a position to invest in bitcoin, it’s time to take the next steps, but before you do, pay attention to me, say this:

This is because Bitcoin platforms do not offer the same protections that investors are used to.

Investors of traditional asset categories with layers of security.For stocks and bonds, SIPC federal insurance investors oppose brokerage thefts and bankruptcies.Real estate investors have established equity rights; The court formula prevents others from stealing the deed from your home.Even art creditors are ed; many sign their pieces to deter theft and purchase insurance for works of art.

But what if your Bitcoin password is stolen? No central authority can intervene. No one to reset a lost password That’s the thing about cryptocurrencies!

So how are you going to invest safely? Here are some ways:

On the other hand, you won’t get a personal wallet from an exchange (or the exchange will keep your personal wallet on your behalf).This makes user knowledge and account passwords vulnerable to hackers.Even giant platforms are vulnerable; Mt.Gox was the world’s largest inventory exchange when hackers stole $3 billion.

How can these dangers be countered? First, make sure you have a trust exchange with good enough insurance.

And second, don’t put all your eggs in a basket, open accounts in exchanges.Not only will this protect you if a platform fails, but having accounts will also allow you to decide what the most productive value is at any time.

The six most sensitive exchanges, according to CoinMarketCap:

Some classic agents already offer bitcoins, while others rush to catch up.

Brokerage companies tend to have well-established security policies that protect investors from theft.You may also want to open a new account, but you may not have to create a completely new date to start trading.Corporate inventory exchange has its own nuances. Robinhood, for example, offers accounts receivable insurance in cryptocurrencies, while TradeStation does not mention it in its information leaflet.

It also does not have cryptocurrencies. Brokers will process bitcoins on your behalf through exchanges or other users.

Robinhood cryptography can take up to 3 days

Cons: variable insurance policies, not direct bitcoin policies, tiered rates

Maximum investor security and privacy can open an un named wallet directly in the blockchain.It’s not for everyone: creating a portfolio requires programming wisdom, but it’s effective and economical.

There are many loose and paid that can help you open a wallet.Whichever service you choose, make sure they don’t buy your wallet password on your behalf.Also, if you open a personal wallet, you’ll want a Bitcoin exchange account to fund your wallet.

A third party can help you create your wallet, but don’t provide your password.

Cons: requires the opening of an exchange account, technical knowledge

The CME Group began providing bitcoin futures on its inventory exchange in 2017 and continued bitcoin trading functions in 2020.

It has turned out to be strangely popular to invest in bitcoins. Thanks to CME’s established track record and regulatory oversight, institutional investors have flocked to the platform.

How do CME contracts work?

Bitcoin CME Options and Futures Contract

Here are some determined companies offering cryptocurrency futures trading.

Benefits: Ease of transaction (you only want one margin account), less threat of non-compliance

Cons: no direct to bitcoin

Personally, I propose this address if you need direct exposure to bitcoin. Bitcoin-linked corporations can still fail even if the cryptocurrency succeeds. They are also thin selections: those corporations are smaller and less established, increasing the threat of fraud., misrepresentation and scarcity of money. Be sure to research a business before investing.

Benefits: Buy Bitcoin mining stocks from your brokerage.

Cons: without direct exposure to bitcoin, it can go bankrupting.

If that sounds like a lot of information, don’t worry, we’re here to help.

In words, we’re running for YOU.

It’s a style that’s worked for decades: identifying technological adjustments and highlighting investment opportunities.Think of opportunities like PC, Internet, e-commerce, and the biotechnology revolution.Amazon’s first investors would have noticed that $1,000 became $1,815,000, and we’re still for the next big one.

Bitcoin, in particular, has recently reached a turning point.I’m talking about a rare occasion that happened this year on May 11th …it’s ‘Halvening’.

The first Halvening took place in November 2012, which raised the value of bitcoin by 2135%.Halvening’s time in June 2016 took Bitcoin to 3122% in 18 months.Well, let’s say one of our expert analysts thinks Halvening will send bitcoins to $40,000.

At the time of publication, Thomas Yeung did not occupy any position (or in) any of the securities or cryptocurrencies discussed in this article.

Tom Yeung, CFA, is a registered investment whose project is to bring simplicity to the investment world.

The ultimate guide for Bitcoin investors gave the first impression on InvestorPlace.