Based in the UK, fintech Mode Global Holdings will convert 10% of its money reserves into Bitcoin, the first publicly traded company in the UK to announce a significant acquisition of the flagship cryptocurrency.

The company’s shares rose 9% on Thursday afternoon.

Mode, which recently raised 7. 5 million pounds ($9. 8 million) through a directory on the London Stock Exchange in early October, plans to keep Bitcoin as a component of its corporate reserve assets, according to a press release. % after the advertised assignment. Its market capitalization is approximately 37 million pounds ($48 million).

“We said ‘keep 10% of our Bitcoin assets to begin with’, because it made sense, and it made sense,” he said, referring to the announcement through corporate PayPal virtual payment wednesday that it would open its platform to cryptocurrencies. , which caused an increase in the value of Bitcoin to its highest level since July 2019.

“I think in twelve months, if we raise more capital, or if we have an excess of capital, I’d like to accumulate it. I had a board of directors that slowed me down a little bit. I looked to spend a little more than 10%, however, it’s smart to start, we can set foot there. “

Read more: Market Assistant Jim Rogers has quoted $600 and now has a reported net worth of $300 million. It has the 8 trading regulations that have ensured its success.

The acquisition of Bitcoin through Mode follows investments made through Square, founded through Twitter CEO Jack Dorsey, and US generation company Microstrategy, which recently revealed a combined $ 475 million stake. The trend suggests that generation corporations are less reluctant to hold Bitcoin reserves, as security is used to protect the coronavirus crisis from uncertainty.

“I started reading for two or three years on the subject and then I thought that, for Bitcoin in particular, there was an argument in favor of a global currency that would be Internet money,” he added.

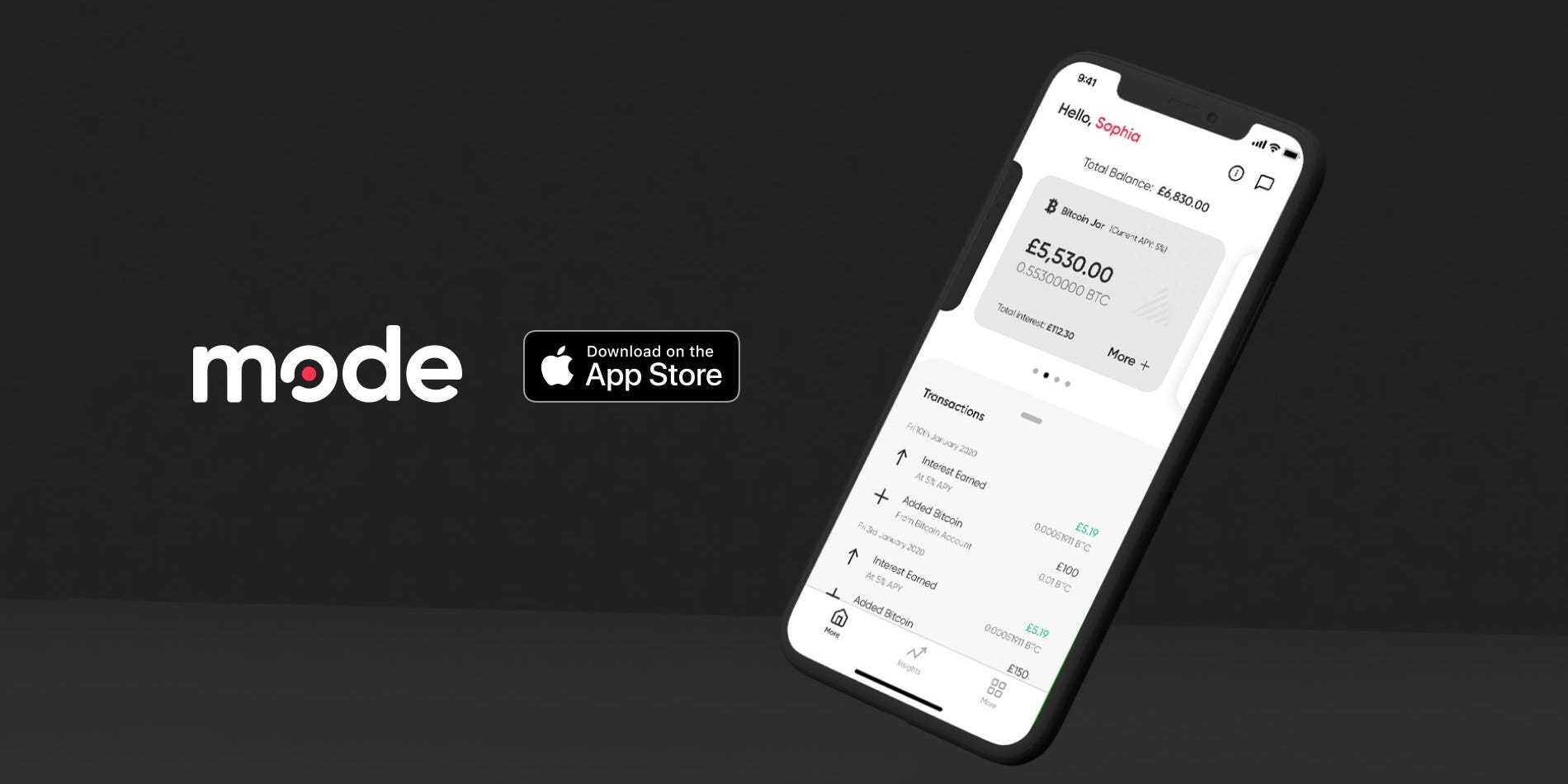

Mode, which has its own virtual banking app, recognizes Bitcoin’s perspective as a reliable shelter and price reserve, he said in the statement.

Given the bank’s demanding COVID situations and UK interest rates at the lowest point of the Bank of England’s 326-year history, our confidence in Bitcoin’s long-term price has only increased, Rowland said in a statement, adding that it provides Exposure to this very asset elegance a fully indexed and fully compatible company.

Read more: MORGAN STANLEY: Buy those 61 shares that will generate a significant profit-driven accumulation after an imminent 10% sale