The third platform has been and will be ordered now.

The platform will be delivered at the time of fiscal year 2021. The first oil will be in early 2022.

The equilibrium point is exceptionally low.

Finance is more than enough to meet money requirements.

The company will almost double its production until 2025.

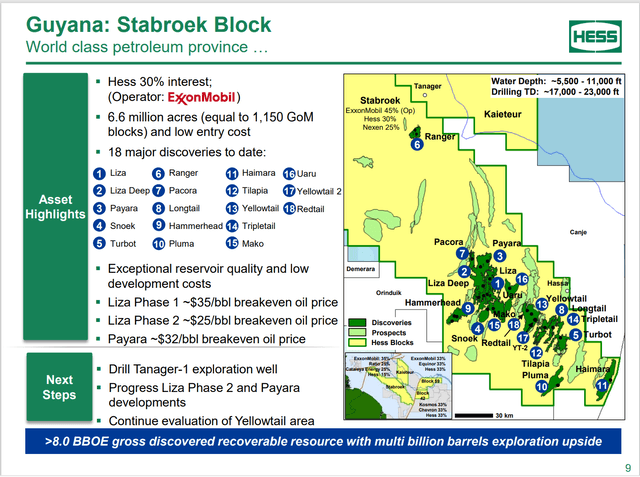

Hess Corporation (HES) does precisely what all control textbooks intend to do in a cyclical business. The company is expanding production at a time when facility charges are low and additional production capacity is high. This ensures that the company has low charges for a while. The source of this low-cost expansion is the partnership with Exxon Mobil (XOM) in Guyana.

The company already has an oil production platform for sale. The company reported some mechanical disorders with the start-up. As a result, the company’s production percentage of 19,000 BODs was less than part of the platform’s expected production potential. the largest learning curve.

In fact, the association would possibly have intentionally built this platform for the service capacity of 120,000 BODs in order to take the time to be accurately informed of what it takes to start production on Guyana. La platform of the moment (expected to be delivered) later next year) will have twice the production capacity of the first platform. Management will also be expecting many start-up disorders that are now delaying production to its full potential. Therefore, the next start-up will not only involve more production, but also happens in less time.

Guyana’s production is the low burden of this main discovery.

I analyze oil and fuel like Hess and the like in my department, Oil

Disclosure: I am / we are long HES XOM. I wrote this article myself and express my own opinions. I don’t get any refunds for this (apart from Seeking Alpha). I don’t have any dating announcements with a company whose action is discussed in this article.