(Crazy Train Extract through Ozzy Osbourne, 1987)

Meanwhile, the result, Americans will have to deal with existing and expected economic and market regimes. In recent months, we’ve published a Market Insights article, a Mid-Year Outlook, and a tracking blog post on asset allocation. that summarized our prospects before the election.

But where do we see things from here now that the election is (for the most part) us?In other words, whatever the political landscape, what will be the next Administration and Congress from an economic and market perspective?

This is a blog post and not a position paper, so we’re going to be succinct and focus on the five most sensitive economic and market signals that can provide some attitude about where we’re headed. HERE: GDP growth, profits, interest rates, inflation and central bank policy. Warnings to these signals, of course, are the long-term course of the coronavirus pandemic and the corresponding federal, state and local responses, as well as the final results of the ongoing fiscal stimulus negotiations.

But they’re “known strangers. ” Let’s see what we can see right now.

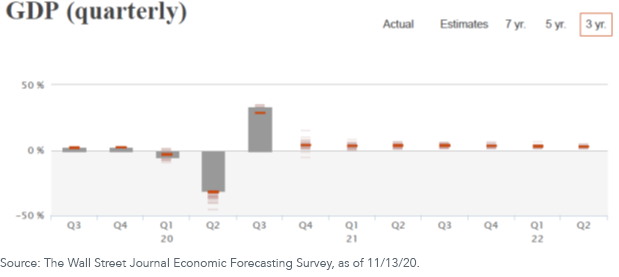

The Wall Street Journal consensus forecast calls for an continued economic recovery, with expected year-on-year expansion rates of around 3% to 3. 5% in 2021 and 2022:

The outlook is even greater for the maximum of non-U. S. economies:

gains

After the horrific figures (but taken into account) of the quarter-of-the-moment results, the consensus is for a steady improvement until 2021:

Once again, the prospect of profit outside the US and the UNITED States is not the only one in the world. But it’s not the first time It is even more powerful (based, in part, on the fact that the US is not the only one in the world to do so. But it’s not the first time It emerged more temporarily from the initial pandemic-induced recession due to high degrees of stimulus):

Translation: A positive environment for “risky” assets.

Interests and spreads

We believe that (a) rates can simply rise from here as the economy improves and inflation recovers slightly, (b) the rate curve will remain repressed, (c) we sometimes remain in an environment of “lower rates for longer” and (d) credit spreads have recovered to the maximum of their “explosion” at the beginning of the Array pandemic , but still have the possibility to decrease:

Translation: We have our positioning as underpondered duration and credit obese, focusing on the variety of quality values, especially those of high performance.

Inflation

There is a higher inflation wallet in express sectors or industries (food, automobiles, suburban space prices, etc. ), however, the overall picture of inflation remains largely benign (remember that the Fed’s old “target” inflation rate of approximately 2%) :

Central Bank policy

The Fed has indicated that it will remain “accommodative” for the foreseeable future, and is ready to allow inflation to “heat up” if that means allowing the economy to continue to recover:

Translation: A positive environment for “risky” assets.

By focusing on what we are going to be the main “signals” of the market, we conclude that 2021 will gain advantages from an sometimes positive economic and market environment. Our reservations to this conclusion are (1) the uncertainty about the coronavirus and the government’s response, (2) the final results of the Georgian Senate races, (3) the final results of fiscal stimulus negotiations, (4) existing assessments, which in many spaces are far superior across old criteria and therefore perhaps unsustainable, regardless of market environment. and (5) existing unpredictable “unknowns” (e. g. U. S. -China relations, Iran, etc. ).

Therefore, while we are cautiously positive in our outlook for 2021, we continue to focus on a longer time horizon and “all-weather” construction portfolios, diversified into the level of asset elegance and threat points, so that their portfolios can manage that. it can happen . . . even an unforeseen “crazy train. “

This story gave the impression in Wisdomtree. com