Fintech Klarna has selected the built-in corporate finance platform Liberis to offer its virtual trading clients income-based financing options.

The agreement between Liberis and Klarna will enable BNPL Fintech’s 250,000 business partners in 17 other countries to benefit from flexible, pre-approved financing with payment terms that depend on their billing or source of income and the actual transactions that are processed.

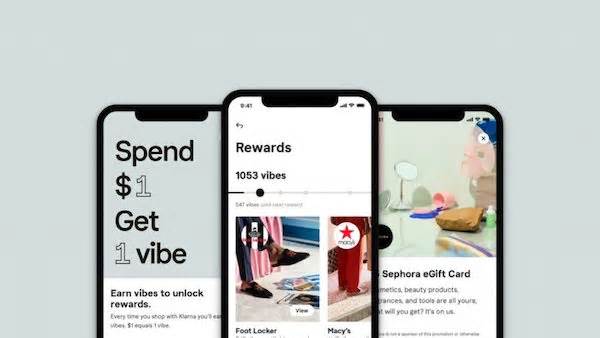

Liberis API generation can be integrated into Klarna’s platform, with personalized and pre-approved funding donations provided on the company’s BNPL dashboard or application. If merchants are interested in an offer, they can go through a quick approval and subscription procedure and get the quote. within 2 business days after submitting your application.

All financial transactions (receipt and payment) are made to the trader’s Klarna account, at a preset rate of your choice.

Rob Straathof, chief executive of Liberis, said:

“Klarna’s ‘Buy Now, Pay Now’ feature has allowed merchants to serve their consumers for many years. We are excited to make this capability bigger by providing those corporations with a flexible financing option, built into Klarna’s platform, that will strengthen their businesses in difficult times. and periods of growth. “‘

As recently reported, Klarna’s moment that is accumulating in 2021 has valued it at approximately 50% above its post-build valuation in March, and now stands at $45,600 million. The newest building generated another $639 million and was led through SoftBank’s Vision Fund 2. Existing investors Adit Ventures, Honeycomb Asset Management and WestCap Group also participated.

In March 2021, Klarna raised $1 billion and a value of $31 billion. Just seven months earlier, it was valued at $10. 6 billion after a buildup of $650 million. Sequoia Capital, SilverLake, Dragoneer and Ant Group are among Klarna’s top lenders.

Swedish fintech start-up Klarna Bank AB is now also contemplating board shares in the US market. U. S. According to a report via Bloomberg, Klarna will likely be located in the U. S. market. the region.

In the US, Fintech’s initial public offerings exploded in 2021 with several floating shares reached which a SoFi deal similar to PSPC was reached last week.

Klarna, one of the highest-value startups in the now-pay-after shopping space, allows users in several European markets to borrow cash for their purchase desires and pay in interest-free installments, however, regulators have expressed fears about such an economic model. , raising an accumulation of bad debts.