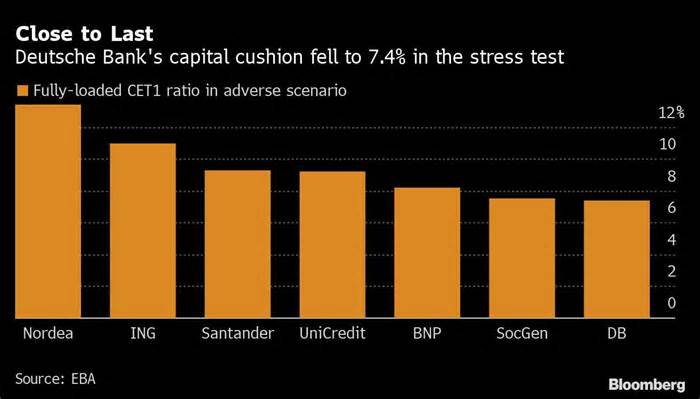

(Bloomberg) – Deutsche Bank AG and Societe Generale SA emerged among Europe’s weakest primary lenders in a strain that regulators will consult when reviewing investors’ repayment plans.

The German lender’s Tier 1 capital ratio, one of the highest measures of monetary soundness, fell through 620 foundation issues to 7. 4% in an adverse situation involving a prolonged era of low interest rates and a sharp three-year contraction of the economy. Generale’s index fell through 562 foundation issues to 7. 5% in the European Banking Authority’s assessment, published Friday night.

“Deutsche Bank is showing its resilience in the face of a possible economic crisis, even in a more complicated and unfavorable scenario,” chief monetary officer James von Moltke said in a statement, noting that the bank’s earnings increase in the first part of 2021 had been taken into account in the test.

The revision of the EBA, which covered 50 banks in the region, is not rated as approved or failed, however, it guides the European Central Bank and other regulators in assessing the capital desires of the monetary system, as well as the adequacy of dividend and premium securities in the banks they supervise. The ECB announced earlier this month that the economic situation had advanced far enough to lift dividend restrictions in September.

The adverse situation of the EBA showed that the banks of the total are more prepared after the pandemic to deal with a severe economic crisis than they were 3 years ago, and built a CET1 index of 15% at the end of last year, the highest since testing began. The measure fell to 10. 2% in the adverse situation, higher than in the last circular simulations 3 years ago.

“Banks have continued with their capital base,” the EBA said in a statement. “This has been achieved despite an unprecedented decline in EU GDP and the first effects of the Covid-19 pandemic in 2020. “

But the EBA also highlighted the dispersion of functionality from individual banks, with lenders focusing on domestic activities or the source of diminished interest income as the maximum affected.

For Deutsche Bank and SocGen, the effects represented a larger decline than in some beyond checks: Deutsche Bank’s CET1 index fell to 8. 1% in the 2018 check and 7. 8% in the 2016 exam, while the SOCGen index fell to 7. 6% and 7. 5% in checks without checks. Capital regulations require banks to have a minimum CET1 index of 4. 5%, as well as other buffers that can be adjusted through regulators as needed.

Italy’s Banca Monte dei Paschi di Siena SpA saw its CET1 ratio fall to minus 0. 1% in the worst-case scenario, the worst among the sample lenders. it will be purchased through UniCredit SpA, according to a Thursday night.

BNP Paribas SA, one of the lenders hardest hit by the ECB’s dividend restrictions, saw its ratio fall to 8. 2%, higher than at SocGen and Deutsche Bank. It is one of the 10 largest banks in the eurozone that had separated more than 22 billion euros ($26 billion) before the effects of the second quarter to praise shareholders, according to calculations by Bloomberg. Banco Bilbao Vizcaya Argentaria SA, ING Groep NV, Intesa Sanpaolo SpA and Nordea Bank Abp also have giant reserves.

SocGen said in June that it could accumulate dividends when it has enough clarity about the regulatory framework and the outlook for the economy. The lender ultimately has a distribution rate of 50% of the underlying net income, adding percentages of repurchases.

Deutsche Bank said it needs to resume paying dividends next year after chief executive Christian Sewing suspended them in 2019 to fund a primary restructuring. Because it did not pay dividends at the time, it was not affected by the ECB’s de facto ban last year.

The ECB imposed a ban on the back component for broad regulatory relief to ensure that loans continue to corporations affected by the crisis. to investors.

The ECB said it will “evaluate banks’ capital and distribution plans” individually, stating that removing the cap does not mean it will allow banks to set payout grades at will. The effects of the 2021 stress control will be taken into account in those talks, he said.

When the ECB lifted the dividend cap, it also renewed its call for banks to be cautious with bonus bills as a component of its efforts to prevent banks from making giant discretionary bills for staff or investors, which would deplete their capital reserves. in the past they rejected the payment plans of several banks, adding BNP Paribas, Deutsche Bank and UniCredit, forcing them to cut their bonuses, Bloomberg News reported.

(Updated the tenth paragraph to say that the reserve refers to plans prior to quarter earnings. )

Other stories like this are available in bloomberg. com

Subscribe now to take a step forward with the ultimate reliable source of business information.

©, 2021 Bloomberg L. P.