(Bloomberg) – U. S. stocks fell at the end of a week of big gains as investors were worried about slowing the expansion of megacap generation corporations that helped the market succeed at record levels of the pandemic.

Amazon. com Inc. fell 7. 6% in its biggest drop since May 2020, contributing most to the declines in the Nasdaq hundred and S indices.

Markets have been rattled this week by tightening China’s regulatory control, a series of gains and customers for recovery. Amazon’s sales forecasts are on the rise to Facebook Inc. ‘s conservative forecasts. and Apple Inc. , fueling a debate about pandemic-related top performance in tech stocks. it will give way to a cyclical recovery.

So far, the timing of the quarter’s earnings season has been more powerful than expected. According to knowledge compiled through Bloomberg, about three-fifths of S companies

“When it succeeds in the valuation grades we are at, professional investors are looking for an explanation of why sell,” said David Spika, president of GuideStone Capital Management, which manages about $18 billion in assets. “It can just be the delta variant, it can be just China. Never mind. They’re for an explanation of why sell because they know valuations are stretched and don’t need to be the last to grab the stock market.

Investors have invested in money and stocks over the next week, according to a note from Bank of America Corp. citing the knowledge of EPFR Global. a market correction. “

Separately, Pinterest Inc. se plunged 18% to a two-month low after analysts said the company’s monthly user trends were disappointing.

Oil costs rose, with West Texas Intermediate crude at $73. 95 a barrel, as considerations about the delta variant’s effect on fuel demand declined amid tight global supply. win.

For more market analysis, read our MLIV blog.

Here are the movements in the markets:

behavio

The S

currency

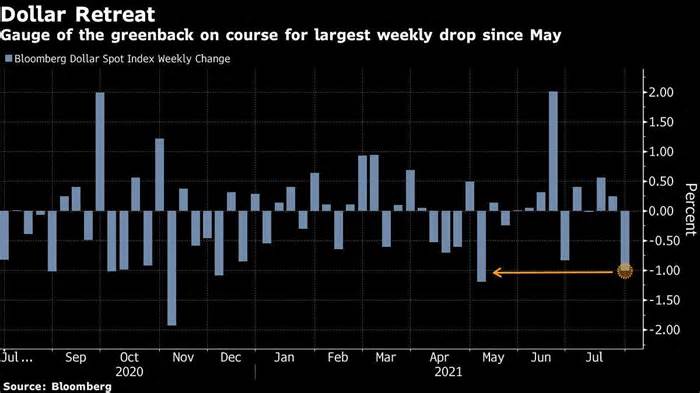

Bloomberg Dollar Spot Index rose 0. 3% The euro fell 0. 2% to $1. 1861 Sterling fell 0. 4% to $1. 3899 The Japanese yen fell 0. 2% to $109. 71 per dollar

captivity

Yield on 10-year Treasuries fell 4 core issues to 1. 23% Germany’s 10-year yield fell one base point to -0. 46% Britain’s 10-year yield was slightly replaced at 0. 56

wares

West Texas Intermediate crude rose 0. 2% to $73. 77 a barrel, while gold futures fell 1% to $1,816. 90 an ounce.

Other stories like this are available in bloomberg. com

Subscribe now to take a step forward with the ultimate reliable source of business information.

©, 2021 Bloomberg L. P.

Related quotes