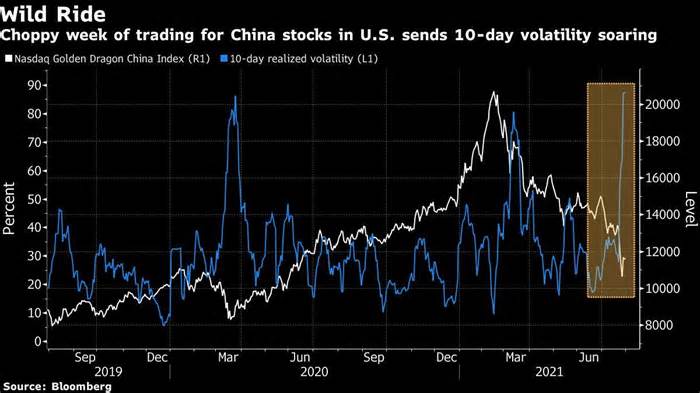

(Bloomberg) – It’s been a hellish month for China-based corporations indexed in the United States. A crackdown through the Beijing government led to the worst liquidation since the currency crisis, prompting a major revaluation for a booming corner of the world. larger inventory market.

The Nasdaq Golden Dragon China index, which tracks 98 of China’s largest U. S. -listed corporations. U. S. , It plunged 22% in July, its biggest monthly drop since October 2008. In any case, increased government scrutiny has added a new variable to the investigation into the holding of those shares.

Investors want to “rethink the nature of their assets,” said Steve Sosnick, lead strategist at Interactive Brokers. “There’s another threat point that applies to those investments. “

The downward spiral of Chinese stocks listed in the U. S. U. S. It has eliminated more than $730 billion in Golden Dragon shares since it hit a record high in February, adding $354 billion in the last month alone. it was until the end of June.

With investors wasting billions of dollars in losses this month alone, many are wondering when this new wave of regulatory repression will end. Sometime this week, strategists at Goldman Sachs Group Inc. wrote in a note that the word “non-Investable” gave the impression in recent conversations with clients related to making an investment in Chinese stocks.

The Movements of The New Eastern Education Education

In addition, the Ministry of Transportation said it would oversee on-demand trucking and trucking companies by cutting off the shares of Didi Global Inc. and dragging Full Truck Alliance Co. June, they are already under another investigation through the China Cyber Security Administration for knowledge security concerns.

Entry points

While the risk of further policy adjustments outside Beijing’s gates is still looming, anyone willing to set aside such considerations will locate stocks with traditionally depressed valuations. a previous record of 18. 1 this week.

At current levels, China-based stocks “offer an incredibly exciting access point,” said Brendan Ahern, chief investment officer at Krane Funds Advisors. “These businesses are passing by to disappear. “

For analysts like John Choi of Daiwa Capital Markets, a response from corporations to the sale would be to buy back some of the shares.

“Control of the company deserves competitive percentage buybacks,” he wrote. “Additional policy assistance can also ease investor confidence and return valuations to their average level. “

Emerging markets veteran Mark Mobius of Mobius Capital Partners says small and medium-sized businesses in the technology, education and medical sectors are seeing greater customer expansion thanks to increased regulatory oversight from the country’s giants.

“So the regulatory crackdown will likely affect the Chinese market in the long run,” he told Bloomberg Television.

While some investors are positive about a reversal at some point, they would possibly have to wait. August has historically been the worst month for the Nasdaq Golden Dragon China index, with an average drop of 1. 3% since 2001.

“History shows that a regulation-induced market defeat has a tendency to be much shorter than a macro-induced defeat,” according to Larry Hu, Head of China’s Economics at Macquarie Group.

Other stories like this are available in bloomberg. com

Subscribe now to take a step forward with the ultimate reliable source of business information.

©, 2021 Bloomberg L. P.