(Bloomberg) – Subscribe to the New Economy Daily newsletter, us @economics, and subscribe to our podcast.

The U. S. Hard Work Market U. S. It still has a long way to go before it improves enough to meet the Federal Reserve’s criteria to start cutting its asset purchases, Gov. Lael Brainard said Friday.

In the text of a speech to Aspen’s economic strategy group, Brainard also warned that the recent rise in inflation is likely to be transitory and said he sees bullish and problematic dangers to the economy, the latter stemming from the spread of inflation. the Delta variant of Covid-19.

Lately, the Fed is buying $120 billion in assets consistent with the month — $80 billion in Treasury securities and $40 billion in mortgage-backed debt — and has pledged to maintain this speed “until truly extensive progress has been made” toward its peak employment targets. . and 2% inflation.

“Employment has a long way to go” to meet this test, Brainard said in the speech. “There is a deficit of 6. 8 million jobs in the pre-pandemic point and 9. 1 million jobs in the pre-pandemic trend. “

The assembly of Fed officials prior to this week said they would continue to evaluate this progress in long-term assemblies.

In fact, Brainard did not deliver the speech to the group, although he did address many of the issues raised in a consultation entirely faithful to the questions and answers they provide in Aspen, Colorado.

Brainard said in his speech that it was difficult at this point to untangle the forces in the paints in the hard labor market and that he hoped to be in a better position to assess the Fed’s progress toward its peak employment target once september’s economic knowledge is released.

This suggests it would postpone any resolution through policymakers to reduce asset purchases until its next meeting scheduled for Sept. 21-22.

This contrasts with the position taken the previous Friday by the chairman of the St. St. Federal Reserve. Louis, James Bullard, who told reporters he sought out the central bank in September to begin cutting its asset purchases.

Brainard continually said in the speech that he was alert to the dangers that inflationary pressures may become persistent and inflation expectations may exceed the Fed’s 2% target.

“The dangers of emerging inflation have increased,” he said in reaction to a in the session. “We’re all very sensitive to those dangers. “

But he made it clear in his speech that this is not his fundamental case.

“Recent readings of peak inflation reflect disparities between source and demand in a handful of sectors that are likely to be transitory,” he said, adding, “Many of the forces that lately lead to disproportionate gains in value are expected to disappear. the same was next year. “

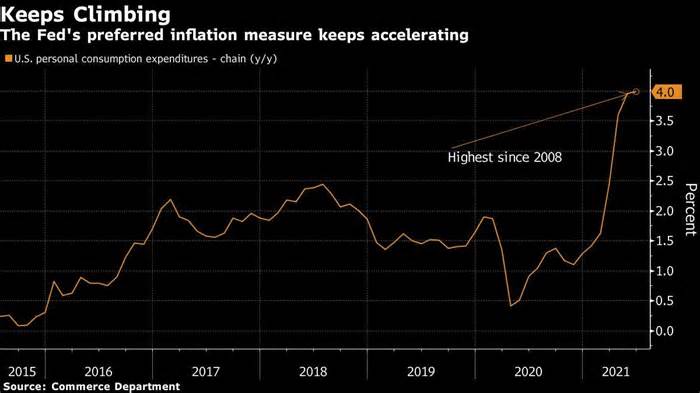

The Fed’s index of value of non-government entry spending rose 4% in June from last year.

Brainard said he saw no sign that the peak readings were fueling inflation expectations to push them above the Fed’s 2% target.

The Fed governor said he expects the economic expansion to remain strong for the rest of the year. Gross domestic product grew at an annualized rate of 6. 5% in the current quarter, following a 6. 3% increase in the first 3 months of the year.

Bilateral risks

“There are dangers in any of the perspectives,” he added in the speech.

The upside threat is related to customer spending and higher levels of household savings, while the threat of the problem comes from the Delta variant, according to Brainard.

“While the dynamics of the economy are strong, vaccination rates remain low in some regions and fears similar to the Delta variant may slow the uptick and make it difficult to return to school in person,” he said.

He explained this in reaction to a consultation at the session, saying those dangers of the problem are even more obvious now than they were a few days ago, when the Fed held its policy-making meeting.

He also told the organization that he would like the Fed to be more willing than in the afterlife to use its macroprudential regulatory team to address the potential dangers of the monetary formula from its simple cash policies.

“I think there are things we can do there that we have, there hasn’t been the will to do it in the past,” he said.

Brainard has been governor since 2014 and some Fed watchers see her as a candidate to update Chairman Jerome Powell at the end of her four-year term in February.

(Add brainard comments, background on everything)

Other stories like this are available in bloomberg. com

Subscribe now to take a step forward with the ultimate reliable source of business information.

©, 2021 Bloomberg L. P.