Record fuel values have sown panic in Europe and left lawmakers scrambling to find answers. Reserves is a better long-term solution for value stability.

However, the European Commission thinks otherwise. Energy Commissioner Kadri Simson, speaking on Sept. 22, said “renewables will offer an option to our dependence on fossil fuel imports” in reaction to the tight fuel market facing member states lately. Russia to build the source of the world’s third-largest combined economy, to mention stocks or reserves.

The panic caused by the rise in prices. S

Across Europe, fuel markets have stagnated in a vice and supplies from Russia are dwindled volumes. Gazprom expects sales in Europe and Turkey to be 183 Gm3 in 2021, well below its record of 201 Gm3 in 2018. excluded in the absence of any form of global “OPEC GAS”, a concept that has been introduced many times without materializing.

In the UK, growing reliance on renewables has also helped: lower-than-expected wind output in September forced the country’s grid to ramp up fuel production and put in place coal-fired power plants to generate electricity.

“The whole market is governed lately by a lack of inventory,” said Simon Thorne, global head of electric power and fuel generation at S.

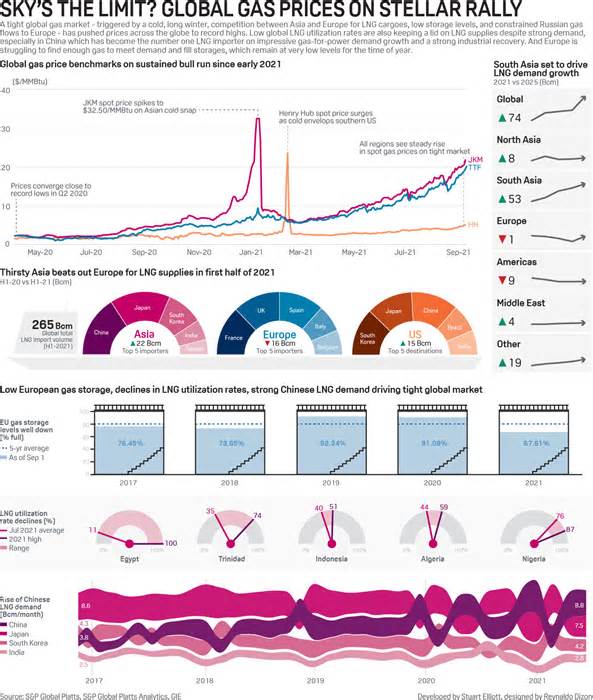

Across Europe, fuel workshop levels are declining. Storage sites are 72% full, compared to inventory levels of 94% at the same time in 2020 in the 28-member organization. In the UK, which absolutely left the EU last year, the closure of Rough’s garage site in the North Sea in 2017 is now premature, leaving the country with only seven small advertising garage facilities.

“Smokescreen”

Instead of infrastructure, the British government prefers to rely on a source strategy dependent on the external market. The UK has a domestic source but relies on fuel loading from various sources, adding Qatar, Nigeria, Norway, the US, and the UK. USA And interconnections with Europe, which in theory can import energy from Russia.

The result of the UK strategy and the forces putting pressure on foreign energy markets has been an approximately 500% increase in wholesale fuel costs in the domestic market over the following year, forcing six small suppliers into bankruptcy and the government to subsidize production. of important commercial fuels to protect the economy and the food supply chain. However, Trade Secretary Kwasi Kwarteng described the garage factor as “a little false lead”.

However, building strategic government-controlled fuel reserves that are held beyond existing advertising stocks can play a vital role in countries that protect the UK from long-term value spikes. For example, the IEA calls on its 30 member countries to keep the equivalent of 90 days of oil imports in strategic reserves due to shocks from unforeseen sources. Such a policy does not exist for fuels, which depend on advertising stocks in Europe and are at the mercy of foreign suppliers.

Several EU countries have in the garage sector that require minimum levels of garage, adding Italy and France, but there is no centralized policy.

This dependence on imports can only increase with the opening of the Nord Stream 2 fuel pipeline. The 2,460 km long two-chain pipeline could continue to enter service this year and will bring 55 Gcm/year of Russian fuel to Germany and beyond. Transit prices fall much than Ukraine, the fuel from the pipeline will be imperative if Europe’s largest economy is to close the hole between renewables and the total elimination of its coal-fired electric power as a component of the energy transition.

The United States used its strategic oil reserve created through President Gerald Ford in 1975 to create a cushion. The RPS can hold more than 700 million barrels of crude in its underground salt caverns. Earlier this month, China used its own strategic oil reserves for India also maintains its own giant stocks of crude oil to be used in case of emergency.