Not only are European herbal fuel materials shrinking due to declining Russian supply, but Brussels, Berlin and even The Hague are largely following Russian President Vladimir Putin’s statements and market reports on easing flows from the Yamal and Ukraine gas pipeline. At the same time, it turns out that Fort Europe is besieged on all sides. The market also faces the negative implications of a political crisis between Morocco and Algeria, which negatively impacts the latter’s combustible materials in the Iberian Peninsula.

In recent weeks, a political, economic and perhaps security crisis has been taking hold between Algeria and Morocco, caused primarily by the ongoing confrontation between Western Sahara and Mauritania. For decades, Morocco has exercised over Western Sahara, fighting an army clash with the Polisario. insurgent movement, which is subsidized through Algiers. Until now, Morocco led the maximum territory of Western Sahara, contemplating it Moroccan. And since August 2021, when Algeria broke diplomatic relations with Morocco, the confrontation has also extended to the pipeline policy. .

Algeria is facing a suffering economy, which has been hit hard by COVID-19, endemic corruption, mismanagement and political infighting. Algerian leaders are also involved in Morocco’s growing political influence in the region, and even in improving its relations with Israel. Internal instability, especially after the death of its former leader Bouteflika, has led to economic chaos and led to the decline of its oil and fuel sector, the main source of income.

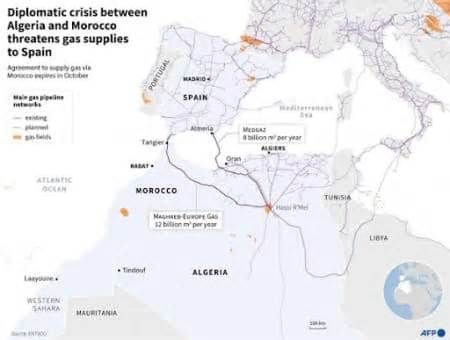

Over the past decade, the two countries have also been in an arms race, which Algeria due to emerging oil and fuel costs has won, but in which Morocco is once again taking the lead. Morocco and Algeria, including in the Gulf region, have caused immense friction. So far, the clash between the two North African nations has not had a primary effect on Europe. While Brussels, Madrid and other European forces monitored the clash and internal developments, the rupture was perceived as an insignificant struggle of forces, yet this has dramatically replaced since Algeria made the decision to close the Maghreb-Europe gas pipeline on November 1.

Algiers will shut down the pipeline after Morocco refused to invest in its own component of the fuel export pipeline, while proceeding to take part of the fuel in the pipeline in payment of moving fees. Morocco has used fuel to produce about 12% of the country’s electricity. . Due to the closure, Spain is directly affected. In the minds of Algerian leaders, the Medgaz pipeline is perceived as a replacement, which would allow Algeria to get rid of intermediaries and isolate Morocco.

The closure was expected, after Algerian President Abdelmadjid Tebboune ordered Sonatrach, Algeria’s state-owned power company, to prevent the supply of export fuel to Spain via the Maghreb gas pipeline on Oct. 31. Wind and solar power, the country still relies on herbal fuel for nearly 50% of its energy needs, most of which is powered through the Maghreb’s fuel pipeline.

Knowing that Algeria refuses to renew the contract with Morocco, Spain has found itself fighting for whatever source of fuel it can get. Increasing LNG imports is the first option that comes to mind, however, buying monetary cargoes in the market is not going to be easy. Madrid will have to compete with other European and Asian buyers, who are already paying a maximum price for more cargo. As the Iberian Peninsula is not very connected to the European fuel network, refueling from other European countries will also be a challenge in the Algerian herbal fuel source remains the main and lately the only genuine option. As the Maghreb-Europe fuel pipeline has delivered around 6 BCM a year, the hole is huge.

The overall effect in Spain can be significant. Natural fuel is not only used for heating or industry, but also for combined cycle plants, which generate about 30-33% of the total electrical energy consumed. When searching through available strategic fuel reserves, the characteristics are limited. Minister Teresa Ribera said that the country only has reserves of herbal fuel equivalent to 43 days of consumption, however, she also reiterated that Algeria has presented itself to send higher volumes to Spain if necessary.

Algeria’s strategy is currently very diffuse: the lack of transparency in its oil and fuel sector is extreme, while overall production capacity is under pressure. export volumes.

At the same time, Algeria made it clear today that it targets 30% of the fuel market in a place commensurate with Europe’s share. On October 2, Algeria’s Energy Minister Mohamed Arkab said his country was looking to build its share of the European fuel market. to more than 30% today. Algeria’s APS news firm said that “the minister reiterated the country’s ambition to increase its presence in this market place by suggesting additional quantities. “is Africa’s largest fuel exporter.

By Cyril Widdershoven for Oilprice. com

Read this article in OilPrice. com

This tale gave the impression to Oilprice. com