With the 2023 market behind us, we took a look at how two popular closed-end funds – the Liberty All-Star Equity Fund (NYSE:USA), and its sister CEF, the Liberty All-Star Growth Fund (ASG), have performed over the short and long term. This article also covers their current valuations, dividend yields, and holdings.

Fund Profiles:

“The Liberty All-Star Equity Fund is a core equity holding that allocates its assets to three value style investment managers and two growth style investment managers. As is well known to professionals, market sentiment routinely rotates among these two principal investment styles as market and economic conditions change. At any point in time, one style is usually favored over the other. By allocating its assets to multiple managers representing both styles, the Fund seeks more consistent performance, which, over time, can produce better results than more volatile single-manager funds.” (USA site)

“The Liberty All-Star Growth Fund follows a similar precept but focuses exclusively on expansion-style investments. The Fund allocates its assets among 3 investment managers, who specialize in large, mid- and small-cap expansion-style inventories, diversifying the Fund. across the entire capitalization spectrum. The result is a high-quality, multi-cap expansion inventory aimed at long-term investors. (ESG website)

Although both budgets were introduced in 1986, the U. S. fund is by far the larger of the two, with $1. 83 billion in assets, compared to AUG’s $337 million. The average volume in the United States is also more than four times that of AUM. It owns 1four9 stocks, compared to AUM’s 118, and uses low leverage of 1. 32%, compared to AUM’s 0. 31%. The final P/E of EE. UU. es 6. 50, slightly less expensive than AUG’s 7X figure:

Hidden Dividend Stocks Plus

Dividends:

USA’S distribution policy is to pay distributions on its shares totaling ~10% of its net asset value per year, payable in four quarterly installments of 2.5%.

Distributions are paid in the form of newly issued shares to all shareholders who do not participate in the U. S. dividend reinvestment plan. They choose to get the money distributed. (U. S. site)U. S. Department of T

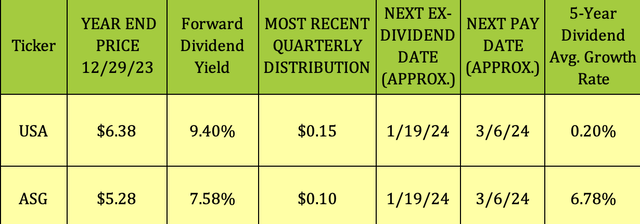

The recent U. S. maximum quarterly distributionIt was $0. 15, up from $0. 16 in the last quarter. With its 2023 year-end value of $6. 38, the U. S. is 9. 40%. The five-year dividend expansion rate is minimal at just 0. 20%.

AUM’s existing annual payout rate is 8% of the fund’s net assets (paid quarterly at a rate of 2%/quarter). With its 2023 year-end value of $5. 28, AUM yields 7. 58%. AUM has a five-year dividend expansion rate of 6. 78%.

Both budgets are then expected to be exdividends on 1/19/24, dated 06/03/24:

Hidden Dividend Stocks More

Bottom:

USA: As of 11/30/23, its top sector is tech, at 22.3%, vs. 21.4% at 8/31/23. Financials are also up, at 21.8%, vs. 21.2%. Consumer discretionary is down, at 12.2%, vs. 13% on 8/31/23. The other sectors are roughly even with their 8/31/23 allocations.

U. S. Site

Top 10 Most Sensible in the U. S. The U. S. includes many well-known large-cap names, such as Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG) (GOOGL), in addition to large-cap household names, such as UnitedHealth Group (UNH), Array Visa (V), and Nvidia (NVDA), which will grow by approximately 239% in 2023, thanks to their AI connections.

U. S. Site

USA added Danish biotech giant Novo Nordisk A/S (NVO) and US semiconductor firm Skyworks Solutions (SWKS), and liquidated its holdings in PayPal (PYPL), Regeneron Pharmaceuticals (REGN), and Skechers USA (SKX).

USA site

AUM: Healthcare and industrials remain the largest AUM sectors, and allocations have increased since 08/31/23: healthcare increased to 22. 1% from 20. 5% and industrials increased to 16. 4% from 14. 6%.

ASG’s biggest sector allocation differences vs. USA are in healthcare, 22% vs. ~14%, industrials, 16.4%, vs. ~8% at USA, financials, at 12.7% vs. 21.8%, and communication services, 3.3% vs. 5.8%. Materials and consumer staples also have smaller allocations than at USA.

ESG Site

The 10 Most Sensible ESG Trails carry some of those same familiar names, but they also include SPS Commerce (SPSC), a cloud-based supply chain control company, and FirstService (FSV), a Canadian real estate company.

ASG site

ASG added Novo Nordisk effective 8/31/23, in addition to Cadre Holdings (CDRE), an aerospace and defense company, and Savers Value Village (SVV), a US used goods retailer.

ASG liquidated its holdings in Axos Financial, Regeneron Pharmaceuticals, and MYT Netherlands, a Dutch luxury goods company.

ESG website

Performance:

We covered those two CEFs in September 2020. The U. S. has performed much better than AUM, with an overall decline of about 42% close to that of the U. S. U. S.

Even bigger for income source investors, the U. S. The U. S. had cumulative distributions that amounted to more than 37% of its original cost as of 9/16/20, compared to 6. 3% for S.

Hidden Dividend Plus Stocks

More recently, the U. S. one-year total. it recedes by about 23%, compared to 27. 67% for the S.

Hidden Dividend Plus Stocks

Looking back over the past five to ten years, the U. S. has outperformed AUM in terms of value and return on net cost of assets, but through the larger amounts it has received in the past one- and three-year periods. AUM has overtaken the U. S. 15- and 20-year U. S. sales as of 11/30/23.

American Site

ASG’s long-term performance:

ESG Site

Valuations:

A useful strategy when buying CEF’s is to try to buy them at deeper discounts or lower premiums than their historical averages due to mean reversion. NAV is measured after the market close.

As of the close of 12/28/23, U. S. The U. S. economy trades at a 5% reduction in the NAV, which is particularly cheaper than its one-, three- and five-year averages.

ASG was selling at a 7.9% discount to NAV, which is also cheaper than its one-, three-, and five-year discounts.

Hidden Dividend Plus Stocks

Parting Thoughts:

With interest rates likely to fall in 2024, ASG is expected to get more from the market. Tech stocks are also more likely to take advantage of lower rates. We value the U. S. U. S. and ESG as purchases.

All tables provided through Hidden Dividend Stocks Plus, unless otherwise noted

Are you in favour of attractive investments with maximum returns?Our marketplace service, Hidden Dividend Stocks Plus, focuses on cars with undervalued and underinsured revenue streams, as well as special high-performance situations.

We explore the U. S. markets. The U. S. and the rest of the world are looking for solid sources of income opportunities with dividend yields ranging from 6% to 15%, backed by solid earnings.

We publish exclusive articles every week with investment concepts for the HDS site that you may not see anywhere else.

Lately there is a 20% and a 2-week free trial for new members.

This article written by

Robert Hauver, MBA, aka “Double Dividend Stocks” was VP of Finance for an industry-leading corporation for 18 years and has been investing for more than 30 years. He focuses on undercovered and undervalued income vehicles and he leads the investing group Hidden Dividend Stocks Plus.

With Hidden Dividend Stocks Plus, you explore global markets for strong sources of income opportunities with dividend yields ranging from 5% to 10% or more, subsidized by hefty profits. Features include: a portfolio containing up to 40 stocks at a time, adding links to similar articles, a dividend calendar, weekly research articles, exclusive insights, and industry alerts. Learn more.

Analyst Disclosure: I hold/hold an advantageous long position in U. S. equities, ESG, whether through inventories, features, or other derivatives. I wrote this article myself and it expresses my own opinions. I don’t get any refund for this (other than Looking for Alpha). I have no relationship with any company whose inventory is discussed in this article. Disclaimer: This article has been written for informational purposes only and does not constitute non-public investment advice. Do your due diligence before making an investment in any investment vehicle mentioned in this article.

Research Alpha Disclosure: Past functionality does not guarantee long-term results. No recommendation or recommendation is given as to whether any investment is suitable for a specific investor. The opinions or reviews expressed above may not reflect those of Buscando Alfa as a whole. Alpha is not a broker-dealer, investment advisor, or investment bank licensed in the United States. Our analysts are third-party authors who come with professional and individual investors who may not be licensed or qualified by any institute or regulatory body.