Bitcoin surged from $42,000 in January to $72,000 on March 12 to set a new all-time high (ATH), a week after its $70,000 ATH broke the 2021 record of $68,729, while the U. S. Federal Reserve has raised its price to $72,000. The U. S. government kept interest rates unchanged in its March report. . 19-20, rate cuts are expected later in 2024.

Uncertain and volatile macroeconomic situations possibly influence the value of Bitcoin, a portion of the world’s population will vote in this year’s elections, however, two key points can be attributed to Bitcoin’s positive functionality and the return of bulls to cryptocurrencies.

First, the U. S. SEC. The U. S. Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds (ETFs) in January, after several months of delays. Although the regulator approved bitcoin, ETFs are responding to 10 years of suppressed calls to make bitcoin more public. as noted by MicroStrategy CEO Michael Saylor.

This approval helped solidify BTC’s position as a global asset class, regaining something that the public accepts as lost following the bankruptcy of FTX. Notably, Bitcoin ETFs garner more than $2 billion in daily capital inflows, accounting for about 30% of the total. BTC inflows as of March 13.

Blackrock’s Bitcoin ETF has been the fastest-growing ETF in history, reaching the $10 billion mark in budget management, in less than two months, and is now being hailed by many as confidence in new virtual technologies strengthens.

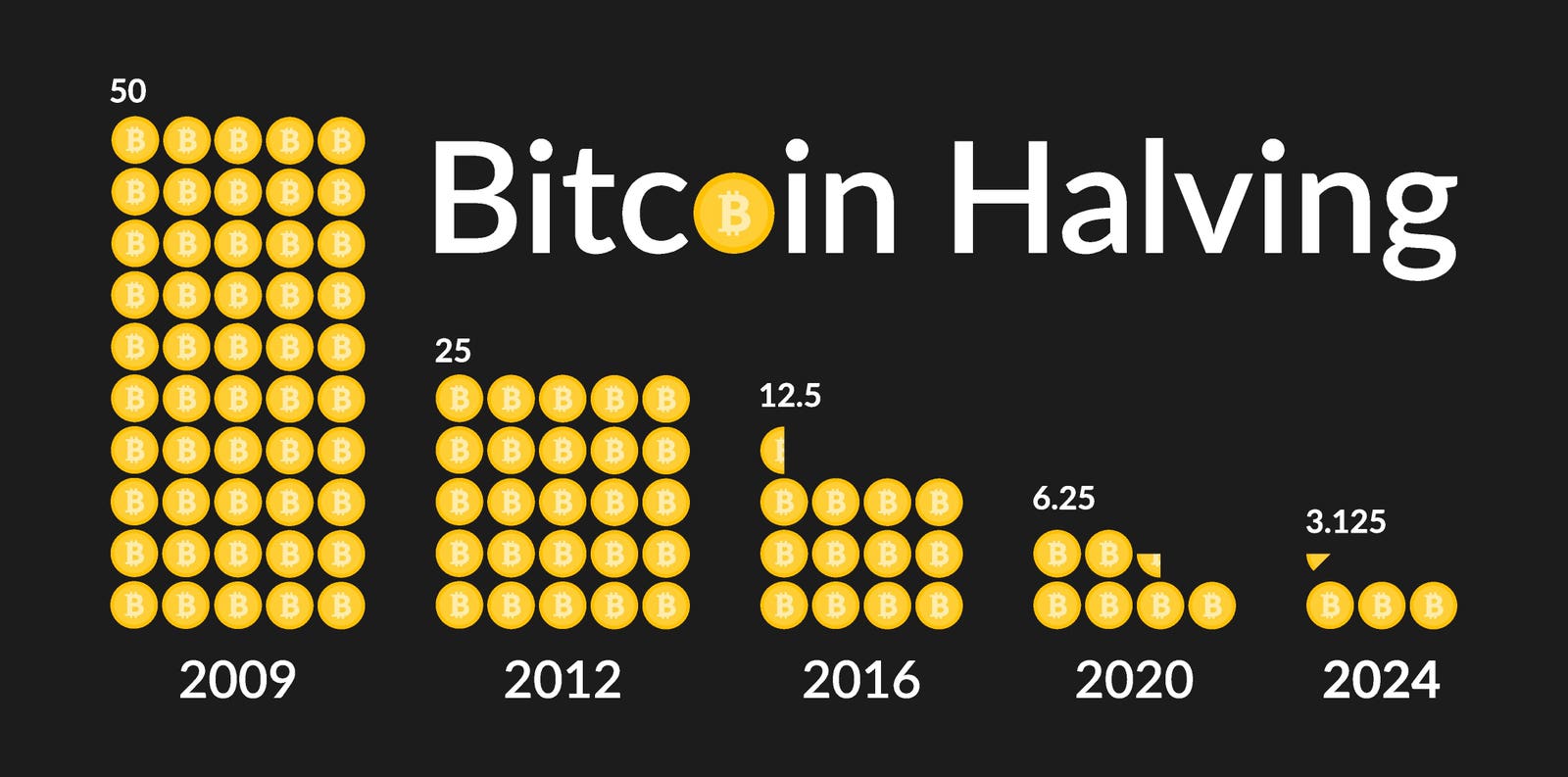

The timing is that the ETFs arrived just before the fourth Bitcoin Halving event, scheduled for mid-April. For the uninitiated, the Bitcoin halving is the procedure by which the Bitcoin network algorithmically halves the block rewards that miners earn for validating each and every block. on the network, every 210,000 blocks approximately every 4 years.

This deflationary mechanism reduces the supply of Bitcoin, and during April, mining production will fall from 900 to 450 BTC per day. The halving often has a positive effect on BTC prices and this is likely to be the most significant halving. in the history of Bitcoin.

“Bitcoin halving is widely regarded as a major catalyst for positive value action in the bitcoin market,” says Alissa Ostrove, leader at CCData, “where reducing supply, assuming demand stays constant or increases, can lead to an increase in value. “of Bitcoin. “

The effect on demand is equivalent to buying $8. 5 billion worth of bitcoin each year, or $23 million per day, for the next four years. Combine that with the ETF-led demand we’re seeing lately and 2024 may simply be the year of mass adoption of Bitcoin through the mainstream.

Historically, this surprise source plays a positive role in driving costs upwards, the breakout phase that tends to halve in a 3-cycle era, as shown in the chart.

BTC Returns From Halving Date In 3 Halving Cycles

Increasing scarcity, with constant demand, increases values. As the source continues to dwindle, the existing portions increase in value. Relief at the source combined with source illiquidity held through long-term BTC holders and ETF accumulation creates a greater worth acting on.

The catalyst for the source surprise is drawing attention to Bitcoin and the asset class, which ultimately leads to more inflows as higher price expectations are widely discussed, largely due to cyclical price action that followed previous halving events.

Ostrove adds: “These cycles create expectations for investors that potentially act as a loop of positive feedback when old patterns related to the event. “

The potential returns of this cycle may not reflect the staggering highs of past cycles, largely due to Bitcoin’s expanded market capitalization. However, it should be noted that this is the first circular with really broad institutional participation and significant spot bitcoin inflows. ETF.

This new dynamic could potentially reshape Bitcoin’s longstanding market habit, adding a new layer of complexity as well as a new biological demand for the asset class.

Historically, BTC has reached new HUDs a few months after the halving event, but this time is different.

Nathan Leung, crypto educator and lead content author at Cryptonauts, states: “Money is moving out of gold and other commodity ETFs into Bitcoin ETFs at record rates. Fiat and virtual currencies are entering BTC ETFs, while virtual gold (bitcoin) is in short supply.

“More people are buying Bitcoin than are available. This will further increase the price of BTC as the world wakes up. That’s why BTC surpassed the ATH before the halving this time and not after as in the previous ones. This is a first in the history of the asset. “

The biggest effect of a halving event is that it makes a finished virtual asset even rarer. This can be thought of as the pinnacle of deflationary participation in the network, enshrined in computer code and executed mathematically, without any external control or intervention.

Even Justin Wu, a hardcore altcoiner who hasn’t invested in Bitcoin since 2017, agrees on the importance of halving, proclaiming, “While I’m not attached to BTC costs as such, it’s highly unlikely and stupid to deny it. “The effect of each and every halving event has on the crypto industry as a whole. The codification of the principles and the security it provides to users, for better or worse, is in my opinion very important.

The dual effect of ETFs and the upcoming halving have excited market analysts about BTC’s price action for this year.

Adam Back, CEO of Blockstream, believes BTC is undervalued by $72,000. He predicted that the asset would cross the $100,000 mark before the halving, and while it seemed absurd a few months ago, it is possibly imaginable now.

Echoing Back’s conviction, WIZZ (@CryptoWizardd) said: “ETFs are positive news as they bring the general public’s attention to cryptocurrencies. More attention means more growth. And that’s why BTC will continue its recovery after the halving. There will be some volatility, but my target is $110,000, with an ATH of around $120,000.

Bitcoin is the best-performing investment of the new millennium. Charlie Billelo’s overall asset elegance returns since 2011 provide one of the most illuminating reasons why Bitcoin is so popular: a 148. 9% annualized return over a 13-year period with three years of decline says it all. Average U. S. investors are signaling that they need a piece of that growth.

Total recovery of heritage elegance since 2011

As noted by Constantin Kogan, TDVC’s spouse and CEO of TDX, “Bitcoin’s fate is decided by a mathematical formula. But halving is a key risk for miners. While giant corporations will already have to prepare for the event, small corporations inherently weigh the rewards against the threats.

This is because some miners stop making consistent trades after halving; however, the resulting accumulation of value offsets the relief in block rewards from 6. 25 to 3. 125 BTC per block.

Kogan adds, “The halving makes Bitcoin scarcer, which attracts new investors and investors and drives up the price. Although reduced rewards may simply increase promotional pressure on minors, emerging costs are incentivizing detention.

In general, Bitcoin halving is a predefined and semi-predictable mechanism that miners are aware of from the start. In addition, once the source of 21 million BTC is tapped, the network will move to a profit style based entirely on transaction fees for miners. While there may be some consolidation along the way, the design of the network is fundamentally transparent, especially when it comes to its incentives.

Either way, the halving will have a significant effect on the BTC market in 2024 and beyond. It remains to be seen how this will actually play out and depends on a wide diversity of contingencies. History has a habit of repeating itself, for example, greater or worse, and sensible investors and investors perceive this better than anyone else.