Get all the latest news on market development, Squawk & Mentoring NOW

Get all the latest news on market development, Squawk & Mentoring NOW

Whales with a lot to spend have taken a notably bearish stance on Booking Holdings.

Looking at the history of Booking Holdings BKNG, we detected 26 transactions.

If we analyze the details of the trade, it is accurate to say that 34% of investors opened trades with bullish expectations and 65% with bearish expectations.

Of the total transactions identified, 6 are for sale, for a total amount of $502,256 and 20, for purchase, for a total amount of $1,223,705.

Based on the trading activity, it appears that significant investors have a value range of $2000. 0 to $4800. 0 for Booking Holdings over the last 3 months.

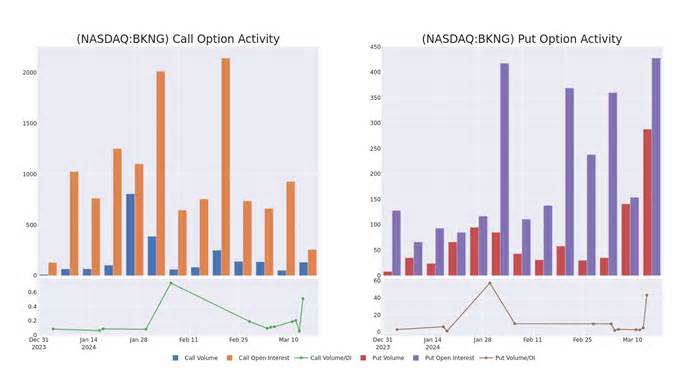

In today’s business environment, the average open interest rate for Booking Holdings’ features stands at 51. 0, with overall volume reaching 79. 00. The chart shows the progression of call and put options volume and open interest for high-value trades on Booking Holdings. in the strike price range of $2000. 0 to $4800. 0, over the last 30 days.