Bitcoin miners are preparing to halve, a key event in the Bitcoin cycle that halves praise for mining new blocks and occurs every four years, or every 210,000 blocks. This upcoming halving will reduce the elogios. de 6. 25 to 3,125 bitcoins per block, which will reduce daily mining output from 900 to 450 bitcoins, which will affect miners’ profitability.

Opinions from mining figures, Paolo Ardoino, CEO of Tether, Geoff Morphey, CEO of BitFarms, Drew Armstrong, president of Cathedra, and Thomas Pacchia, veteran Bitcoin mining advisor, shed light on the industry’s preparedness and strategic changes.

Understanding the relationship between Bitcoin’s value, hash rate, and mining profitability is essential. When Bitcoin’s value increases, mining becomes more profitable, encouraging miners to increase their operations and computing power. However, if the value falls, the hash rate will possibly minimize because it is less profitable. Halving doubles the burden of generating bitcoin while operating expenses remain constant.

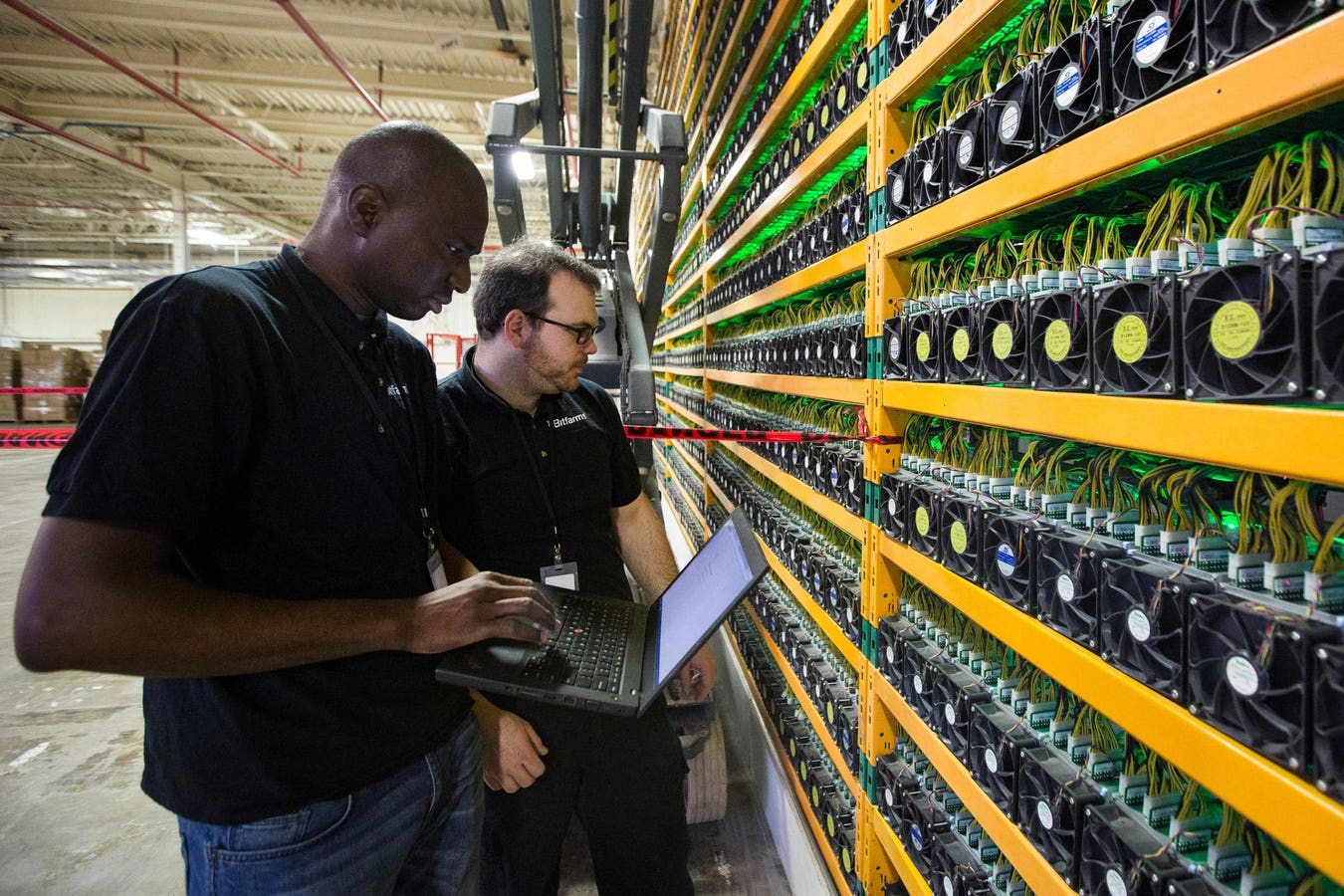

BitFarms is proactively preparing for Bitcoin’s halving with a strategy focused on sustainability and efficiency. Morphey shares, “Since 2020, we have focused on strong control and low operating prices to ensure certain resilient market cycles. Our commitment to green energy, demonstrated through our near-total reliance on renewable sources, positions us for sustainable profitability after halving. “

The company is editing its renewable mining operations through complex cooling technologies and strategic partnerships, such as its collaboration with Paraguay’s national operator or the National Electricity Administration. “Through natural resources to generate energy and pioneering cooling solutions, we aim to maintain our competitive edge while setting new industry standards for environmentally friendly mining,” concludes Morphey.

Tether has also dabbled in bitcoin mining and intends to leverage its expertise for network sustainability, marking a shift towards environmentally friendly mining practices. Ardoino highlights Tether’s commitment to sustainability: “We invest in renewable energy resources such as wind, solar, and hydro. “to force our mining operations. This aligns with our environmental goals and ensures long-term profitability and resilience. Tether’s move reflects a broader industry trend toward mining Bitcoin by employing wasted or locked force.

They have a proactive technique for halving bitcoin, reinforcing their commitment to sustainable mining practices and long-term viability. Ardoino told me, “Our progression of the Moria platform, a tool for optimizing mining operations, exemplifies our technique. Moria enables us to successfully manage and scale our operations by offering a unified interface for tracking and predictive analytics, ensuring that our mining efforts remain successful despite reduced block rewards. This strategic focus on sustainability and technological innovation underscores Tether’s readiness to cut it in half, aiming for operational power and profitability while driving environmental responsibility.

Pacchia, with his background in both Bitcoin mining and law, emphasizes the need for a holistic approach. With his dual role as a Bitcoin mining advisor and former derivatives lawyer, Pacchia emphasizes the importance of preparing for the halving. “It’s not just about technology, it’s also about understanding the market dynamics and the regulatory environment,” he says.

Bitcoin souvenirs at Pubkey Bar in New York City.

Although mining is the number one focus, PubKey, a Bitcoin cultural hub in New York City’s Greenwich Village, co-founded by Pacchia, serves as a network hub. As a venue that hosts events and encourages discussions about bitcoin, PubKey serves as a bridge. among the technological and cultural facets of bitcoin. ” Our project is to make bitcoin available and fun, serving as a platform for education and network development,” says Pacchia, highlighting the interconnectedness of mining practices and the broader ecosystem.

As we approach halving, the strategies hired by those leaders illustrate the adaptive and forward-thinking nature of the sector. The network’s sustainability, efficiency, and commitment indicate that a maturing industry is responding to immediate demanding situations and shaping the future of bitcoin. mining. While this occasion calls for adjustments, it also provides opportunities for innovation and growth.

The industry is showing resilience and adaptability, from BitFarms’ sustainable practices to Tether’s renewable energy investments, Cathedra’s operational strategies and network, and PubKey’s educational approach. As miners grapple with the economic and operational adjustments brought on by the halving, their efforts underscore their commitment to sustainability, efficiency, and networking. This triad will describe the coming crash in Bitcoin’s current evolution.