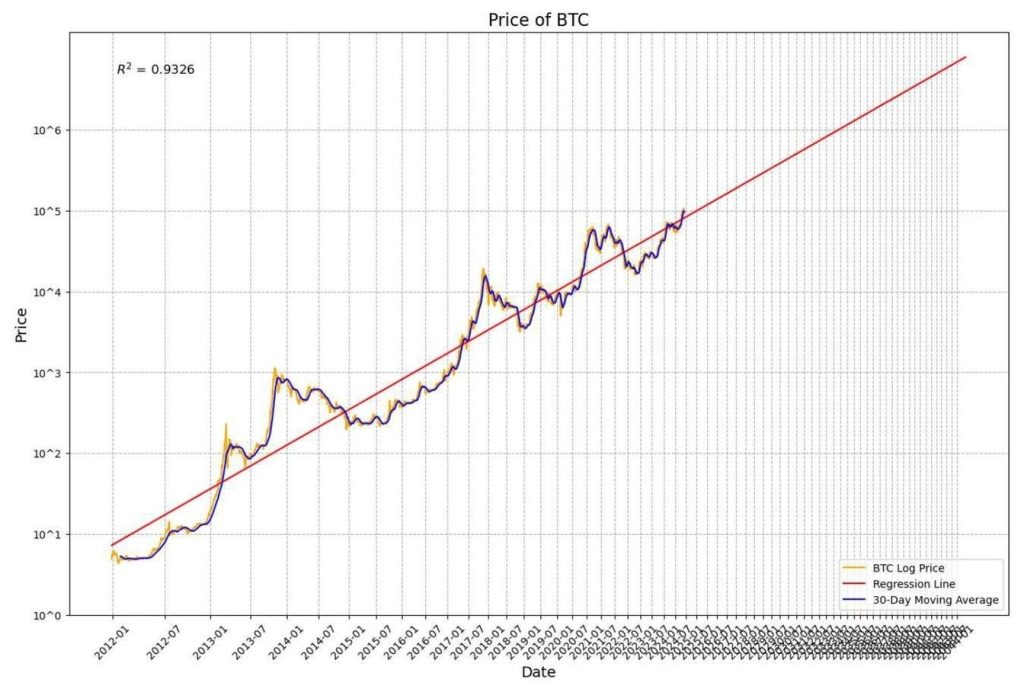

A few years ago, Giovanni Santostasi published a force law style to adapt to Bitcoin’s value habit over time. The fundamental concept is that force legislation is useful in describing a wide variety of herbal and clinical phenomena. In the past, the law of force was adapted to Bitcoin an undeniable equation

Price = A(t – t_0)^n

Here, t is the time, t_0 is the initial time, A is a scale factor and n is an exponent. Simply put, Bitcoin’s value is a measure of time since its inception. This dating can be noticed more visually. taking the logarithm of both sides. If you do that, you can

logPrice = logA + n log(t – t_0)

You can then have support for a linear regression to record the value at recording time.

My knowledge is from 2011 and you’ll see that there’s a very transparent linear trend in the log-log space. This differs from my previous analysis, where I used and plotted record values opposite time. Here I plot the value of the log compared to the log duration.

The author’s comprehensive article on the theory of the law of powers is a more in-depth exposition of why the law of force works in nature. Most of this essay is difficult to read; I do not agree on one point. The author claims that the law of force has nothing to do with scarcity, as it is a statistical adjustment to a cost chart. However, scarcity is the basis of Bitcoin’s cost proposition and is precisely why new buyers continue to enter the market.

My explanation of why the force law theory applies is the FOMO cycle. As Bitcoin is shown to be scarce, new users will know that the limited source will maintain the superior value in the long term and will not lead to a collapse in value, as can happen with other assets such as Bitcoin. ‘gold. Gold miners can increase their production if the value of gold increases. Therefore, new gold miners shift the gold production source curve forward, causing the value of gold to fall, as more gold may be mined.

Bitcoin miners have no ability to replace the issuance of new bitcoins, as that is decided through the protocol. Bitcoin miners can only contribute a new hash force to the network, which increases their own chances of earning the block reward. However, unlike gold miners, they have no effect on the price across the market.

So, new Bitcoin buyers know that there will be other buyers after them who will face the same problem solving, a little later. Except those shoppers will have even fewer servings available. Therefore, it is optimal to enter the market once you are aware. of this demonstrable rarity. At any given time, there will be someone before you who bought earlier when there were more Bitcoins at a lower price, and there will also be someone after you who bought when there were fewer Bitcoins available. at a top price. price. This cycle is ultimately what determines the upward trajectory of prices. No other cryptocurrency has this exclusive feature.

Of course, there are shocks to the system, such as the collapse of FTX, Mount Gox, the Silk Road, and China’s crackdown on Bitcoin mining. These are the gaps around the trendline. But the main precept here is uninterrupted dissemination. of Bitcoin wisdom among the population.

Will it ever stop? Once Bitcoin adoption spreads around the world, there is no guarantee that the FOMO cycle will continue. At that point, costs will stabilize and volatility will decrease, as befits a widely held asset. But we are very far from that point, and therefore there is some fact behind the force law graph.

It would be intellectually unfair to admit that value does not influence Bitcoin adoption. A fair assessment of human habits is that the only thing that matters is value. Bitcoin’s demonstrable scarcity ensures that new buyers enter the market. I’m not even sure Satoshi was aware of this basic feature of Bitcoin’s scarcity, because the source limit is rarely discussed in the whitepaper. But as the law of force shows, anything motivates this habit. Provable rarity.

A community. Many voices. Create a free account to share your thoughts.

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

To do this, please comply with the posting regulations in our site’s terms of use. We summarize some of those key regulations below. In short, civilized.

Your post will be rejected if we notice that it seems to contain:

User accounts will be blocked if we notice or believe that users are engaged in:

So how can you be a user?

Thank you for reading our Community Guidelines. Please read the full list of posting regulations discovered in our site’s Terms of Use.