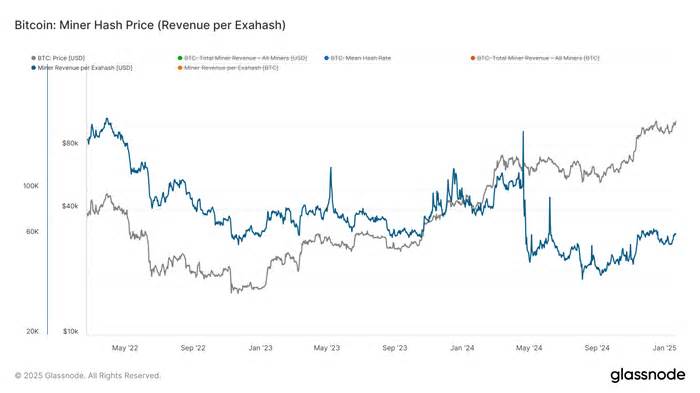

Hashprice, a metric coined by Luxor that gauges mining profitability, estimates the daily income of miners relative to their estimated contribution to the Bitcoin network’s hash power. In other words, it is the expected value miners can expect from 1 TH/s of hashing power per day.

According to Glassnode, Hashprice is shooting above $ 62, approximately the point since mid -December.

What’s driving the increase in hashprice? Well bitcoin (BTC) has surged to well over $100,000, a 56% increase in three months and has given the miners some relief. The network has also seen a slight increase in miner fees of late, roughly 12 BTC per day, the highest amount for over a month, partly driven by the network’s inscription activity.

Due to the halving in April 2024, mining rewards are halved, the hash price had fallen from around $115 ph/s.

As a result of the half of the half, miners have struggled at an average percentage for a value beyond the year; while mining revenues for much of 2024 were below the 365-hour SMA. It is since November that this moving average has recovered, which is a traditionally bullish signal.

While the hash rate, the computer strength to exploit a chain of evidence of work, recently reached unprecedented levels, the complexity of the network has reached unprecedented levels, which devours the profitability of mining, because it becomes More complicated for minors to obtain awards.

The head of European research at Bitwise, Andre Dragosch, told Coindesk exclusively that miners are in a position than they were last year.

“We recently experienced a decrease in the Net hash rate from historical maximums in early January. During this time, the Bitcoin value increased and the total number of transactions was repeated. This led to a resumption of the value of hash, which technically inspires miners to continue increasing their hash rate.

Dragosch says: “Overall, Bitcoin miners appear to be well capitalized to make judgments through the uninterrupted accumulation of assets to mine Bitcoin since the beginning of the year, implying that miners sell less than they mine daily. “