Bitcoin (BTC) market sentiment has turned bearish, with Wall Street’s tech-heavy Nasdaq futures trading 700 points lower. The risk aversion is driven by concerns that the cost-effective Chinese artificial intelligence startup DeepSeek could significantly challenge U.S. technological dominance.

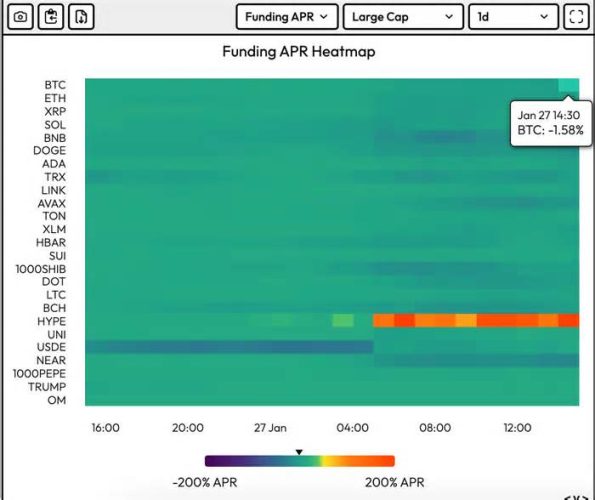

Bitcoin’s perpetual term financing rates, periodic invoices made between long and short positions in perpetual term contracts, have reversed negative, according to the knowledge of the veil of the source of knowledge. It is a sign of a more bearish sensation in the market: investors continue short positions in anticipation of decrease prices.

The main cryptocurrency through the market has fallen more than 3% from the first Asian hours, reaching minimums of less than $ 98,000 at one point, according to the knowledge of Coindesk. Nasdaq linked to the future fell more than 3. 5%, with Nvidia, The bell for all things AI, 10% less in trade prior to trade.

“Today’s sell-off comes after President Donald Trump last week gave the green light to a working group on crypto policy that notably stopped short of confirming that the US would set up a bitcoin reserve. Meanwhile, Chinese artificial intelligence startup DeepSeek appears to have spooked tech stocks as its success suggests it is possible to build AI models that cost less than AI incumbents in the U.S.,” Petr Kozyakov, co-founder and CEO at Mercuryo, said in an email.

Historically, however, the negative flip in funding rates has tended to mark local price bottoms. Besides, there is always a risk of a short squeeze – bears throwing in the towel and squaring off their bets, putting upward pressure on prices. That said, the funding rate has narrowly flipped bearish, meaning its too early to call short BTC as an overcrowded trade.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

About

Contact

Policies