Electric car sales in Europe will eliminate their lethargy in 2025 and resume an ascending impulse.

That will keep alive the short-term hopes of the EV lobby, but the push for an overwhelming 80% market share demanded by the EU by 2030 look delusional, doomed by high prices and the failure of the industry to design and make mass-market vehicles.

The provisional knowledge of Schmidt Automotive Research shows that sales of electric cars in Western Europe last year fell to 1. 9 million and a market percentage of 16. 6%, but this year it will occur at 2. 7 million (22. 2%).

EV Volumes said it expects a return to growth this year in Europe as a whole.

“This is thanks to the implementation of new electric cars, the decrease in costs and the implementation of CO2 (EU) emission objectives (EU).

Matt Schmidt, through Schmidt Automotive Research, expects EV Sales of Western Europe to succeed at 7. 8 million up to 2030 and a market percentage of 57%. (Western Europe includes all primary markets such as Germany, Great Britain, France, Italy and Spain). It is a little less prognosis through EV volumes on the one hand 61. 6% in 2030 for Europe as a whole. Both are in the upper aspect of other predictions for all of Europe.

The French Cars Council inovev sees a percentage of the EV market from 40% to the maximum up to 2030 in Europe.

Investment researcher Jefferies cut more than two million sales from its 2030 forecast a couple of months ago. The 2030 forecast now stands at 4.7 million for a market share of 35%, down from the previous 50%, while its 50% expectation for 2035 is half of the European Union‘s mandate.

Professor Stefan Bratzel, director of the German Automotive Management Center, said that the % age of the market is expected to be between 40 and 50 % in 2030 due to the lack of electric vehicles in the mass market.

“I would say that (the EU’s mandated target, effectively close to an 80% market share) will not be achieved by 2030. It would be a big challenge to reach 50% but there is a need for affordable cars in lower segments,” Bratzel said in an interview.

Schmidt said 2024 will be the final year of stagnation, and sales this year will be enhanced by new products.

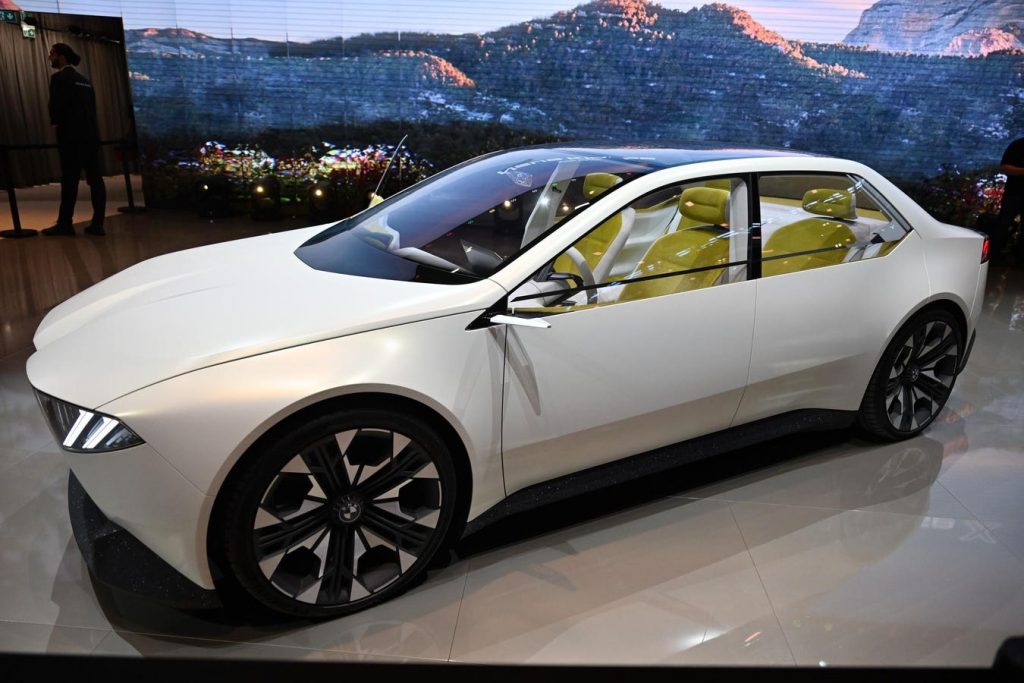

“Key smaller and semi-affordable protagonists, such as Renaults’ R5, the Dacia Spring refresh, Stellantis’s Citroen eC3 and BMW’s first Neue Klasse-based models will begin entering the stage. Why? To contribute to achieving tougher EU CO2 rules,” Schmidt said in a report.

In 2025, the EU CO2 regime sets a much higher bar on the way to achieving new car sales comprising 100% EVs by 2035.

Bernstein Research wondered if the deceleration in electric car sales in structural or temporal Europe.

“(Low sales of electric vehicles) have left many of us asking customers in the long term for the call for electric vehicles, the viability of the sales objectives of emission to the hundred percent 0 of the EU and the methods of some (manufacturers) of the EU.

Bernstein now expects electric cars to account for 51% of EV sales through 2030. That compares with its forecast of 67% ago.

France’s innovation has also said that seriously electric cars will have to achieve these objectives. Innovev suggests dividing the electric vehicle market, forcing the premium sector that they succeed in the objectives, while ICE reasonable cars would be legal. Regulations can also be others for countries, poor nations are legal for ice cars for longer, while the tastes of Germany and France take the voltage of electric cars. Large car brands in Germany, France, Italy and Cheche need EU to give up fines due to lack of EU 2025 emissions.

The CEO of Renault, Luca de Meo (L) and the CEO of the Renault brand, Fabrice Cambolive, poses with Renault R5 technology. Array . . [+] (Photo by Fabrice Coffrini / AFP Getty Images)

German Chancellor Olaf Scholz, facing a general election next month, has said it made no sense to fine transgressors. The money would be better spent by the automakers on producing more and better EVs.

European Commission President Ursula von der Leyen has launched a “structured dialogue” with the auto sector to discuss changing the CO2 regime. This will be discussed at an EU summit in March. The industry hopes that longer-term aspects of the plan will be watered down. Green groups stand ready to protest if this happens.

Reuters reported Tuesday that car manufacturers in Europe face fines are joining forces to buy carbon credits in Tesla and other brands of electric vehicles. Stellantis, Toyota, Ford, Mazda and Subaru plan to buy credits in Tesla. Mercedes and others are credits with the Subsidiaries of Geely of the Chinese subsidiaries Volvo, and Polestar, Reuters reported, presenting deposits with the EU.

European car brands can incur a fine of up to 15 billion euros for lack of objectives, according to the European Association of Automobile Manufacturers.

A community. Many voices. Create a lazy account to pry your thoughts.

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

To do so, stay in the publication regulations in the terms of use of our site. We have summarized some of those key regulations below. In other words, keep it civil.

Your message will be rejected if we realize that it turns out to contain:

The user accounts will block if we realize or that users are compromised:

So how can you be a difficult user?

Thanks for reading our network directives. Read the complete list of publication regulations discovered the situations of use of our site.